Insights

By: Peter McLean

Has inflation finally peaked in the US?

Balance of probabilities points towards lower inflation in the next 6-12 months

Broad market focus remains on global inflationary trends and their impact on the future path of interest rates and growth. The stubborn persistence of US inflation has been a primary source of investor anxiety over the summer months.

Inflation is a good example of a lagging economic indicator. By the time it is reported it is already old news, telling us only what has already happened. In 2021, the Federal Reserve were willing to add some forward looking commentary to this rear-view mirror assessment of price pressures, describing the inflationary surge at the time as ‘transitory’. This justified remaining extremely accommodative in their policy stance, despite strong economic growth and high inflation. By the end of last year they were forced to back pedal in dramatic fashion, as inflation trends proved them far too cavalier on the issue. The approach taken in recent months has been quite different - it is a case of ‘show me don’t tell me’ inflation is falling.

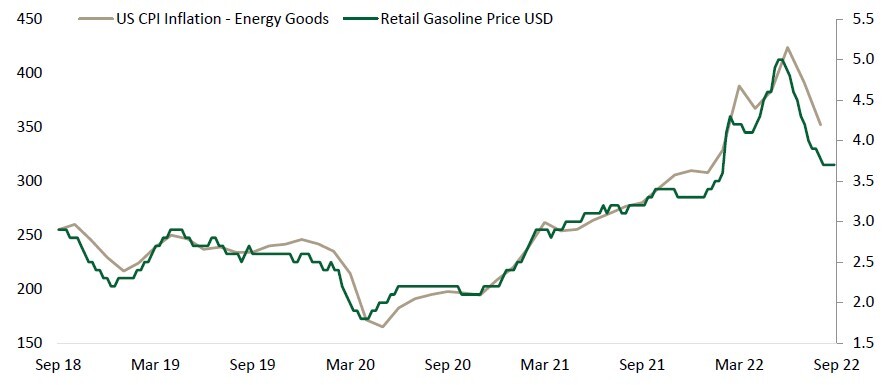

We argued last quarter that “the signs suggest many pandemic-related inflationary factors such as elevated demand for goods and supply chain disruption are much improved”. Despite some surprisingly high readings over the summer, this statement continues to be backed by the evidence. A c.25% fall in gasoline prices since the middle of June has helped (see chart), but the main reason to expect subsiding inflation in the months to come is the resolution to last year’s supply chain disruption.

Zero-Covid policy in China remains a hindrance, however all the evidence points to a considerable improvement in shipping, delivery times for wholesalers, inventory levels and producer input prices. In some cases, indicators of supply chain stress are back to pre-Covid norms.

Falling gasoline prices since June are dis-inflationary

Source: Bloomberg, 30 September 2022

Why is inflation still so high?

The reason inflation is still so high is because it takes time for prices to adjust, particularly from very high levels. A critical factor here is gross margins in the wholesale and retail market. Last year’s ‘bottleneck economy’ resulted in a significant increase in aggregate mark ups in industries where demand outstripped supply. The US auto industry is a good example. Shortages in key components on the assembly line resulted in a huge widening in auto dealers margins, inflating prices for the consumer even more than the rise in input costs would imply.

Ultimately, margins have to revert to more normal levels, which will act as a headwind to inflation. Lael Brainard, Vice-Chair of the Federal Reserve, shares this view, stating “a reduction in currently elevated margins could make an important contribution to reduced inflation pressures in consumer goods” (Source: Federal Reserve, Speech by Vice Chair Lael Brainard, “Bringing Inflation Down”, 07 September 2022).

Other factors will also be key, including how quickly rent inflation subsides and whether the decline in energy prices is sustained. However, our assessment of the balance of probabilities continues to point to lower inflation in the next 6-12 months than the past 6-12 months. Expectations of a 1970s inflationary spiral should look less realistic as a result.

Read more on the Economic Outlook

Disclaimer: This article has been prepared for information only. The opinions and views expressed on any third party are for information purposes only, and are subject to change without notice. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes.

All investments risk the loss of capital. The value of investments may go down as well as up and, you may not receive back the full value of your initial investment. Changes in the rates of exchange between currencies may cause the value of investments to go up or down. We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194). This document has been approved for distribution in the UK, Switzerland and South Africa. Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for the provision of financial services by the JFSC.

© Copyright Stonehage Fleming 2022. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.