Insights

By: Peter McLean

Investment Viewpoint: AI Mania And Looking Through the Noise - Peter McLean

Nvidia’s rapid rise has dominated headlines and stirred investor concerns. In the wake of its latest results, Peter McLean outlines key insights to consider when navigating this fast-changing sector.

In recent weeks concerns around the formation and imminent bursting of an ‘AI bubble’ have gathered steam. As Nvidia crossed the line to become the world’s first $5trillion market cap in recent weeks (having roughly doubled since tariff-related volatility), you do not have to look very far to find some hyperbolic reporting. Forbes recently suggested that an “AI Bubble May Burst, Wiping Out $40 Trillion From Nasdaq[1].” It’s not surprising that some of our clients are asking about allocations to US equities, with market indices becoming increasingly concentrated in the semiconductor and hyperscaler companies.

As long-term investors, it is essential to look beyond sensational headlines and thoughtfully assess what the profitability prospects of the sector's leading companies may be, and whether sentiment may be excessively optimistic. As mentioned in our recent Quarterly Investment Outlook, evidence of euphoric excess and disregard for good sense are not comparable to what we witnessed in the late 1990s. But there are some signs that investors may be extrapolating recent history far into the future.

We have previously highlighted that companies such as Nvidia stand apart from the telecom’s giants of the 1990s, like Cisco, in that their exceptional growth in both revenues and earnings has underpinned their share price appreciation, rather than relying solely on expanding valuation multiples. This limits the risk of a bubble-like mania developing. However, it does not guarantee that the current phase of robust revenue growth will persist in line with investor expectations. In this regard, there is a risk that investors may be mistaking cyclical revenue streams for those that are genuinely structural.

Several economists and analysts have drawn the comparison to the Airline industry. Airlines are indispensable for the global economy today, but it is often cited that the aggregate industry has never actually made a profit. A McKinsey article this year noted that “airlines in aggregate have a long record of mixing positive growth with negative economic profit[2].” The significance of the airline analogy lies in their similarly high capital expenditure requirements and the fact they offer a largely standardised product with minimal scope for economies of scale. Airlines only manage to achieve robust profit growth when demand consistently outpaces supply. A glance at the operating profit trajectory of US airlines illustrates this point perfectly: strong growth in the immediate post-pandemic years of 2021–22, but otherwise a notably flat trend. This example offers a useful warning against excessive enthusiasm for hyperscalers and semiconductor companies. While it may be true that demand for computing power currently exceeds supply, driven by technology giants racing to secure their positions as leaders in the emerging AI landscape, this phase is unlikely to endure indefinitely. Eventually, the clamour for additional processing power, infrastructure, and chips may well subside.

Investment Implications: Getting The Balance Right

At present, there are few signs that the environment is shifting away from the supply-constrained phase of the cycle. Notably, SK Hynix, the Korean semiconductor manufacture and Nvidia’s main chip supplier, has reportedly already sold out of its 2026 chip inventory[3]. This dynamic underpins our ongoing investment to core US equity holdings which access these key AI players. However, meaningful uncertainties about the future and heightened valuations prompt us to maintain a globally diversified portfolio and to keep our exposure to AI leaders below that of the broader market.

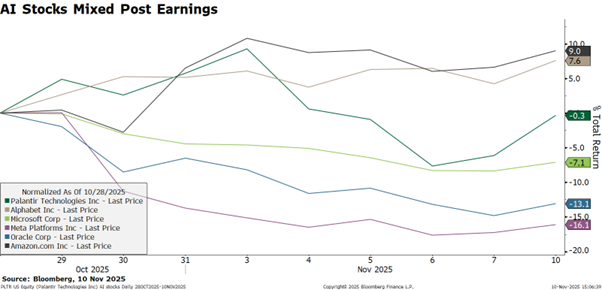

As we look to 2026, we are closely monitoring two main developments to guide portfolio decisions. First, we are alert to signs that capital expenditure growth and chip demand is starting to slow and fail to meet investors lofty expectations. Hyperscalers might pause or slow their investment surge to focus on generating durable profits from existing assets. In which case, robust demand for companies like Nvidia, AMD and SK Hynix may struggle to meet and exceed expectations, as the market adjusts to a slower phase of the cycle. Second, we are watching for signs that capital spending continues to accelerate but market sentiment deteriorates in response. Companies announcing major expansion, possibly funded by debt, may face negative market reactions. Recent examples include Palantir, Meta, and Oracle, which posted strong earnings and guidance but saw stock prices fall. Conversely, Amazon and Alphabet performed well following further capex growth announcements (see chart below).

Past performance is not a guide of future returns.

1 Forbes article, 15 October 2025

3 SK Hynix article, October 2025

Disclaimer

This communication has been prepared for information purposes only and is not intended for onward distribution. Opinions expressed here are as of the date of publication and subject to change without notice. It is not a recommendation to buy or sell any of the investments mentioned herein.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).