Insights

By: Peter McLean

Is the global economy heading for recession? – Peter McLean

The consensus mood of investors has fluctuated wildly over the past month. Having grown confident that the global economy was entering a ‘soft landing’ earlier this year, fears of imminent recession spread at the end of July. More recently, the assumption of US consumer resilience has been at least partly restored.

Financial markets have also experienced sharp volatility during this period. Whilst calm has now returned to markets, questions remain on whether the global economy is at meaningful risk of recession.

Global growth is moderating

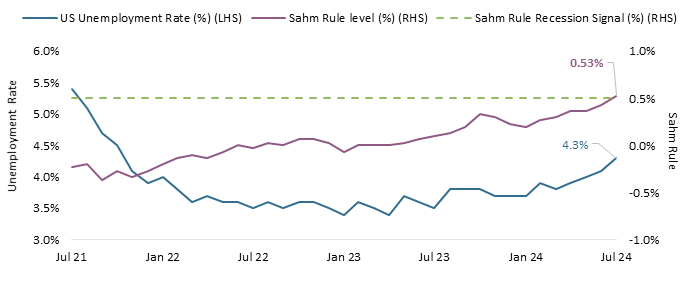

Evidence of slower growth is not hard to find. Firstly, the US economy is no longer firing on all cylinders. For most of the past three years, job vacancies have been plentiful, keeping unemployment at historically low levels. As the demand for new hires by US employers has been gradually softening, new entrants to the labour force have brought the jobs market back into balance after post-pandemic excesses. This means the unemployment rate has risen more than expected to 4.3%, triggering the ‘Sahm rule’ recession signal[1]

(chart 1).

Chart 1: Rising US unemployment a harbinger of recession?

Source: Bloomberg, July 2024.

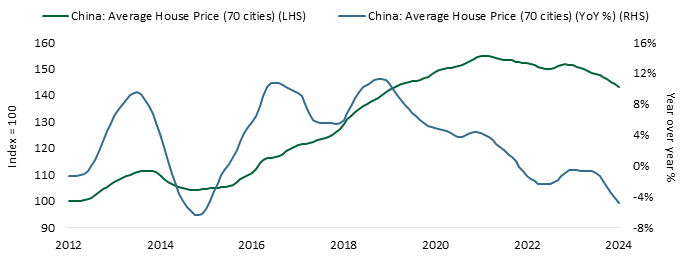

Secondly, following a period of stability and increased optimism, China is weakening anew. The household sector, which represents 39%[2] of the economy, is suffering from rock-bottom confidence levels, weighing on spending. To a large extent this is due to further deterioration in the real estate sector (chart 2), which represents the largest source of wealth for Chinese households.

Chart 2: China’s real estate sector shows no sign of life

Source: Bloomberg, July 2024.

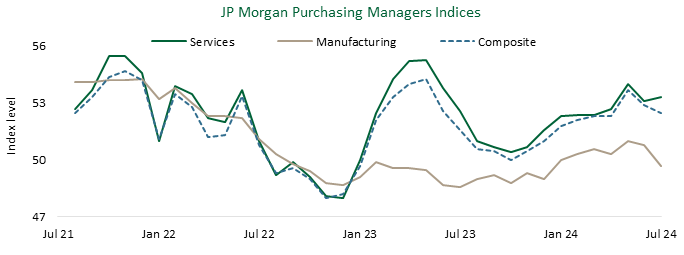

Furthermore, China is over-producing across many industrial sectors. This creates what Foreign Affairs magazine describe as “the risk of a doom loop of falling prices, insolvency, factory closures and, ultimately, job losses[3]”.

This deflationary cycle threatens global growth, flooding markets with cheap goods and weighing on manufacturing industries (chart 3) – a particular problem for Europe, which is also showing signs of renewed economic weakness.

Chart 3: Manufacturing is weighing on the global economy

Source: Bloomberg, July 2024.

Should investors panic?

Some investors may take fright from these developments, since recession goes hand-in-hand with falling corporate earnings and painful market declines. Our judgment is that the global economy is slowing, but is far from crashing. In particular, the weakness in the US labour market is not as alarming as it may seem. In prior US recessions, rising layoffs were the primary driver of a higher unemployment, creating a vicious cycle of lower spending and falling corporate earnings. Currently, layoffs are fairly stable; according to BCA Global Research, a much higher proportion of the rise in unemployment this year has been a result of an increase in labour supply, compared to prior recessions.

Falling inflation should also help. The US, Europe and UK all have inflation rates below 3.0%, having peaked at c.10%, with little evidence that the disinflationary process is over. This will support real income and spending, and create the space for central banks to reduce interest rates. Lower interest rates can help alleviate the pressure on consumers and businesses, with the Federal Reserve expected to cut rates in September. This should all be a relief for investors. While further volatility may come, we are not yet seeing evidence that recession is upon us.

REFERENCES

[1] The Sahm rule states that when the three-month average US unemployment rate rises by 0.50% or more from its 12-month low, the US economy is in recession.

[2] Source: Ned Davis Research, August 2024.

[3] Source: Foreign Affairs, “China’s Real Economic Crisis”, August 2024.

DISCLAIMER

This communication has been prepared for information only and is not intended for onward distribution. It is neither an offer to sell, nor a solicitation to buy, any investments or services. Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).