Insights

Is US Exceptionalism on the Way Out?

Graham Wainer on the Factors Determining How the US Can Hold the Top Spot

Globalisation has been hugely instrumental to global growth and profitability over the last several decades. But has globalisation had its day? asked Graham Wainer Stonehage Fleming’s CEO Investment Management, at our sixth annual Family Investment Conference in London last week.

“Globalisation has reigned supreme for so long – particularly in the US – but now it seems to be on the reverse, in favour of de-globalisation, regionalisation, protectionism and autarky.”

Other factors have further caused investors to ask existential questions around the world order, he added. “Some bad actors entering the picture; the drying up of the peace dividend, which had contributed so much to post-war global growth, with the Department of War having replaced the US Department of Defence and defence costs spiralling in the UK and Europe. And finally, the advent of AI now leading many to question the very meaning of life.”

Graham’s key message for investors was clear: stay vigilant as nothing is immune to the threat of change in the modern world. “The rules keep changing, the goalposts move, and it’s only sheer luck if the strategy that has worked for you for the last 15 years continues to work in the future.”

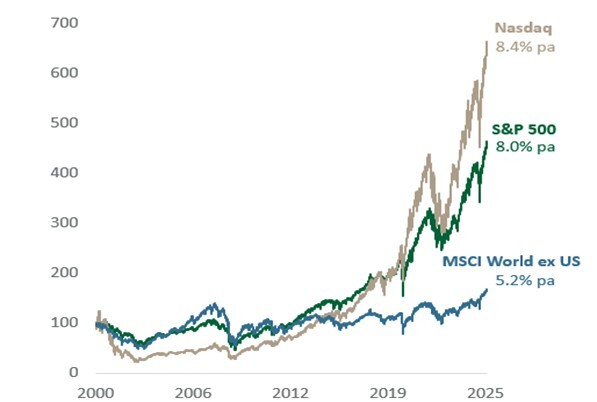

Source: SFIM, Bloomberg, Total Returns in USD (rebased to 100), October 2025

Pointing to equity market performance, Graham highlighted the US economy’s clear outperformance over the last 25 years (see chart above). However, 2025 and since Liberation Day on April 2nd of this year, though the USA has done quite well, other economies are coming to the fore. Could all this sound the death knell for US exceptionalism?

The home front – key measures of internal exceptionalism

Graham interrogated five key criteria according to which investors could still view the US as exceptional. “Let’s start with military power. Russia and China may be building themselves up but realistically America is not under threat because of a lack of military power. Capital market debt is still extremely strong in the US – it has the deepest capital markets in the world. The Americans still boast the best universities in the world. Entrepreneurial culture and pro-business policies are strong and when it comes to energy security and cost, the USA has more energy than it knows what to do with it.”

In terms of fiscal health, Graham conceded, “Americans may be spending more, but then so is everybody else.”

As for demographics, while many nations are dealing with the burden of aging populations, “America is actually aging at a slower rate relative to the rest of the world,” said Graham. And the rule of law is robust which adds to its structural integrity: “The court system in America still works pretty well,” he noted.

Graham questioned the idea that these things, which have driven US exceptionalism for so long, are giving way to economic renaissances in Europe, the UK, China and elsewhere.

Looking outward: four mainstays of economic and political dominance

The debate around America’s global economic and political dominance in the context of the other global players, he argued, centres on four critical pillars: whether the US remains creditworthy, is a trusted trade partner, can maintain the US dollar as a reserve currency and finally whether it can hold on to its position as the global guarantor of the post-War liberal order.

First to the US’s creditworthiness, Graham explained why overseas holders of American debt have grown wary. “Foreign ownership has fallen from 60% in 2010 to 35% today, driven by fears of asset confiscation or defaults under measures like Section 899 (see chart below). If foreign investors retreat further, the costs of funding the debt will be so much higher.”

Source: SFIM, Bloomberg, October 2025

On trade policy, Graham feels that using the threat of tariffs to achieve economic and political objectives may become less attractive as a tactic for the US. “We know that in the short term, not being a trusted trading partner and essentially bullying its trading partners into submission has achieved results for America. But in the long term, free trade benefits the US way more than anybody else. Historically, it has allowed America to import deflation and enabled real income to rise. Plus, of course, if you don't put tariffs on other people, they don't put tariffs on you, therefore there's more for you to sell.”

As for the dollar’s role as the global reserve currency, “Americans like to say that they want the dollar to remain the reserve currency, the global reserve currency. But actually, in practice, for President Trump and others, they regard a weak dollar like a tariff on imports and subsidy on exports. So, while it won’t impact US exceptionalism in the short term, in the long term, it will make borrowing more expensive as their impact on global affairs reduces. That would create space for alternative reserve currencies to come in, like the Chinese Renminbi, and the US will not want to let that happen.”

And finally, to America’s role as global guarantor of the post WWII rules-based order. Graham questions whether it is just those under the US’s watch that benefit from their role as global policeman. “It is important to remember that US benefits a great deal from a stable world. And you can see this reflected in the gold price. One of the reasons for its current rise is that a lot of central banks are buying gold due to a lack of trust in a US reserve and money in US bonds. For me, it reflects a growing unease with their conduct in general, across all these factors.”

The US government, concluded Graham, will not be immune to the effects the potential long-term effects of their policies will have on their global standing. Instead, his faith lies in the fact that their good sense and instinct for self-preservation will prevail.

“Reports of the end of American exceptionalism are greatly exaggerated,” he said. “There are two main reasons for this. First, they have no real competitors for dominance to speak of. And second, they won’t let it happen. They are smart and, ultimately, will reverse any strategy that is hurting their position at the top.”

Graham Wainer was speaking at our annual Family Investment Conference 2025.

Disclaimer: Opinions expressed here are as of the date of publication and subject to change without notice. Stonehage Fleming Investment Management Ltd shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions contained herein or their use, which do not constitute investment advice, are provided as of the date written, are provided solely for informational purposes and therefore are not an offer to buy or sell a security.

Any information which could be construed as investment research has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

Past performance is not a guide to future returns.

All investments risk the loss of capital.

Issued by Stonehage Fleming Investment Management Limited (SFIM). Authorised and regulated by the Financial Conduct Authority (194382) and registered with the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No. 46194).