Insights

Why ‘Age of Risk’ is driving growth for the non-life insurance sector

Non-Life insurance provides diversification amidst the best underwriting environment for a decade

In many ways, we are living in an ‘Age of Risk’ – a period when traditional and non-traditional threats are converging. There are numerous examples of this: extreme weather events, pandemics, wars, acts of terrorism or incidents such as the collapse of the Francis Scott Key Bridge in Baltimore in March this year. Though these risks are numerous, they all have one thing in common – they increase the complexity of the challenges faced by businesses, governments and individuals. The result is that the long-term growth trajectory for insurance companies is being enhanced as awareness of risk and the demand for protection grows. It’s a trend that looks set to continue.

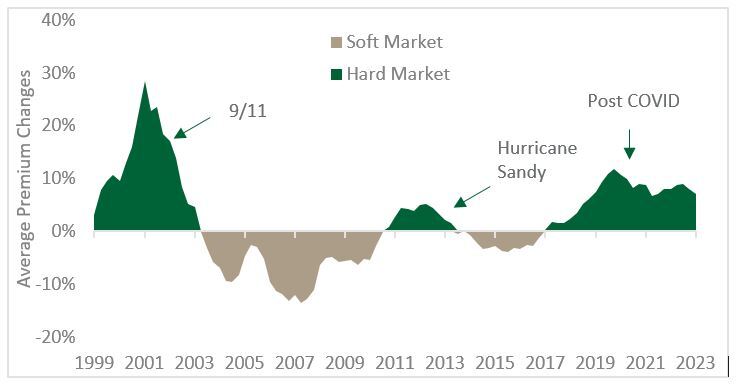

INDUSTRY WITNESSING MATERIAL PREMIUM INCREASES

Furthermore, new avenues for growth and change in the insurance sector are emerging. Rising geopolitical tensions are creating more uncertainty which is driving the development of new products. Cyber Insurance, for instance, is a potentially fast-growing market as incidents of data hacks and cyber fraud continue to rise. Trends such as ‘reshoring’ and the build-out of renewable energy and data centre infrastructure for AI is resulting in new physical assets to insure. Meanwhile, although regulatory and legislative pressures are certainly not new for companies, the scope and complexity of incoming regulations does create new risks, such as the risks of not looking after personal data properly under the EU’s GDPR rules, or falling foul of US sanctions on Russia or China.

The insurance industry is not immune to risk and indeed is facing disruption due to technology and more complicated risk management requirements. However, this creates opportunities for insurers to modernise their systems, leverage their customer data and adopt new technologies, using generative AI to price risk more effectively, gain new insights and improve productivity. There are also opportunities for insurers to expand into faster-growing international markets, such as China or India, where insurance penetration remains low.

Amidst this strong structural backdrop, insurers find themselves in the best underwriting environment for a decade. Both insurance premiums and volumes are rising, while elevated bond yields are flowing quickly into insurer investment portfolios.

From a portfolio perspective, the insurance industry offers valuable diversification properties. Insurance companies are the beneficiaries of higher investment yields. They are also less impacted by economic slowdowns due to stable demand for the product, often mandated by law. And finally, they boast strong balance sheets and regulatory oversight, making the sector an attractive investment theme for investors.

Disclaimer

This information does not constitute legal, tax, or investment advice. It is neither an offer to sell, nor a solicitation to buy, any investments or services. Our expectations and beliefs are based on reasonable assumptions within the bounds of what we currently know. Opinions expressed here are as of the date of publication and subject to change without notice.

Issued by Stonehage Fleming Investment Management Ltd. Authorised and regulated by the Financial Conduct Authority (FRN.194382).