Insights

Holistic Risk Management for Families

The growth of the wealth management sector over the last 20 years has been fuelled by the promise to clients of a new, holistic and strategic approach. At the heart of the proposition is more intelligent risk management.

Many new risk management tools have been devised by innovative individuals and institutions, seeking to develop a competitive edge. Useful and ingenious though some of these tools are, the overall result is disappointing, in that most of the innovation has remained narrowly focused on the volatility of investment portfolios, without addressing the broader risks affecting family wealth:

- For many clients, the investment portfolio represents only part of the family wealth. Any risk appraisal which does not take full account of wider business interests, and other assets is therefore incomplete.

- The investment industry’s conventional approach to risk is mainly based on volatility and ignores the fact that there are many other ways of looking at investment risk, from the perspective of the family and taking into account a longer term horizon.

- No account is taken of the intangible and unmeasurable risks, which numerous studies suggest are the main causes of family wealth destruction (refer Chart A and Chart B).

The reality is that today’s families face an increasingly complex world of potential risks. This paper suggests a broader approach to risk management, which includes those less tangible and non-financial exposures. It is not as scientific or academically well founded as established methodologies, but is essentially based on well-structured common sense combined with a simple process, which ensures all risks are addressed in their proper context.

The Risk Exposure

The inevitable follow-on question is how to define risk and to identify and prioritise key risk exposures. There is no single correct approach to this question as it depends on one’s perspective. For a portfolio manager it is legitimate to focus primarily on the risk of the investment portfolio and to manage that risk by diversifying across a range of investments. By contrast, however, the clients are frequently entrepreneurs, who often manage risk by concentrating their investments in a few sectors which they know and understand.

For the wealth manager, with a broad mandate, an analysis of risk requires an understanding of the family’s wealth objectives. If this basic foundation is omitted from the process, the result is that all subsequent considerations and planning are conducted in a vacuum.

Indeed, a recent study by Stonehage Fleming, “Four Pillars of Capital for the Twenty First Century”* found wide agreement among families that defining a clear purpose for their wealth is a crucial step for wealth preservation across generations.

The challenge, of course, is that no two family’s objectives will be the same. However, a potential hierarchy of objectives might be as follows:

- To provide financially to ensure appropriate living standards for family members

- To maintain a successful family business which provides significant employment and makes a contribution to the community

- To maintain and grow the value of the overall family wealth

- To preserve family unity and prevent dispute

- To provide a fund which enables family members to make entrepreneurial investments or to pursue other beneficial activities

- To provide a fund for philanthropic causes, which may or may not involve family members

- To establish and uphold a lasting family legacy

FINANCIAL AND NON-FINANCIAL RISK

Financial risks include the possibility of an absolute loss, a failure to meet objectives or falling below minimum benchmarks. For many ultra-high net worth families, however, an absolute loss of wealth (even if a significant percentage of the whole) may not seriously damage lifestyles, nor even drastically impact on their ability to fulfil their main objectives.

Non-Financial risks, could include damage to the family reputation, a major family dispute, loss of family values and work ethic, or the destruction of a family legacy. In many senses the non-financial risks are the more important. For instance, a family dispute or lack of family leadership is far more likely to lead to a major destruction of financial wealth than any asset allocation mistakes in the investment portfolio, or the failure to insure a tangible asset.

It is also extremely difficult to put a price on the ‘non-financial’ benefits associated with continuing to own a successful family business, when a purely financial risk model may suggest the holding should be diversified. Equally the benefit of a united family with transparent governance is hard to quantify.

However, any analysis of long-term threats to family wealth should take account of the fact that most family fortunes are dissipated within three generations and, according to numerous studies, the principal causes of wealth destruction arise from those unmeasurable risks which are so often overlooked.

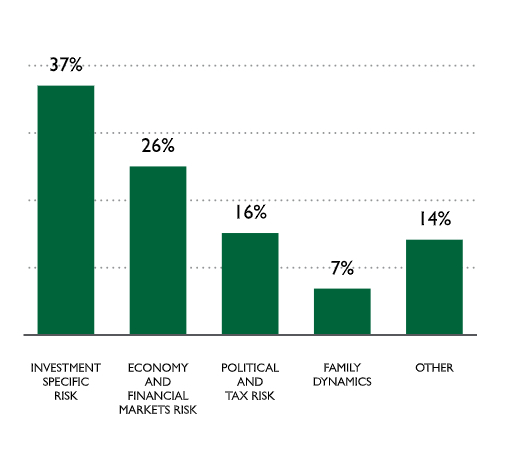

Surprisingly, many families continue to identify investment risk as their primary area of exposure, despite the fact that very few have ever lost their wealth purely through poor investment management (Chart A).

* Four Pillars of Capital for the Twenty First Century, Wealth Strategies for Intergenerational Success, 2015

CHART A: FAMILY PERCEIVED RISKS

(Source: Family Office Exchange, 2014)

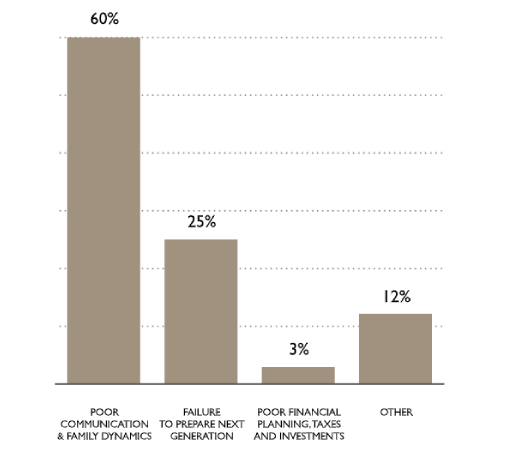

On the other hand studies conducted after the event, on families whose wealth had been severely dissipated, indicate that such wealth destruction was most frequently caused by poor communication and family dynamics and a failure to prepare the next generation (Chart B).

Chart B: Actual Family Risks

(Source: Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values, Williams & Pressier, 2003)

Of course not all risks can be avoided, but a structured and strategic approach will at least help to mitigate the risks and add to the likelihood of wealth being successfully passed from one generation to the next.

The Risk Mapping Analysis

The proposed approach to family risk management brings to families a system of analysis and control similar to the risk management processes routinely used by businesses and other commercial organisations. In some respects the discipline of such a process is even more necessary in a family than in a business, precisely because emotional considerations can easily lead to important issues being avoided.

The family risk management strategy should be developed from a hierarchy that takes into account both financial and non-financial risks:

- Develop an awareness and understanding of the potential risk areas

- Understand the potential impact of each risk upon family wealth and on the family itself

- Rank risks according to perceived levels of materiality, determinability and pervasiveness

- Consider the potential for discrepancies between the actual and perceived risks

- Develop and implement a mitigation plan for each major risk exposure

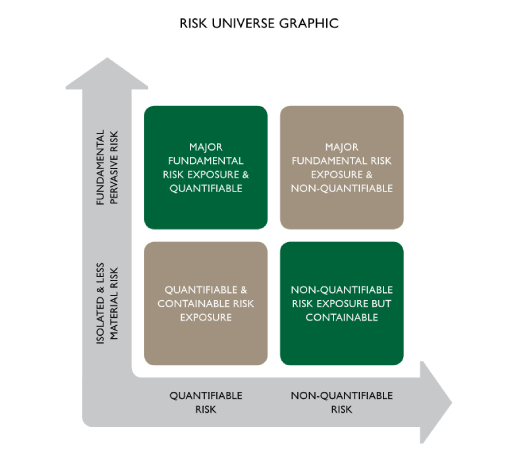

It can be useful to distinguish those risks which are quantifiable and can be isolated, from those which cannot be quantified and are more pervasive. Risks can thus be classified into one of the four quadrants depicted in the risk universe graphic below:

(Source: Stonehage Fleming, 2016)

Assessing the family’s risk universe in this way, may impact quite significantly on the approach to individual risks:

- The discipline of such a process ensures all risks are considered and none avoided

- Risks are prioritised, so that attention is focused on those with greatest potential impact

- Defining risks more specifically, helps to suggest potential mitigation measures

- It drives documentation of a risk mitigation plan

- It helps identify groups of different risks which can be managed together, rather than individually

- Perhaps most crucially of all, since interpretations of risks can differ considerably between family members, this exercise helps to bridge such differences and develop a unified and integrated approach

The result is an intelligent assessment of the family’s risk universe to develop a risk mitigation plan which records risks, probabilities, impacts and mitigating actions.

The risk mitigation plan is ideally developed through collaboration with family members to achieve buy-in. The plan should be considered dynamic and reviewed on a regular basis.

Such an approach should lead to refinements in the investment risk appetite, asset allocations and acceptable time horizons.

Conclusion

By focusing primarily on those tangible risks for which there are ready made solutions, we believe too many families, and their advisers, fail to address the more complex, less tangible and less measurable risks which are so often the cause of family wealth destruction.

We believe a process such as this will facilitate a more comprehensive and effective approach, which will help protect family wealth and family wellbeing across the generations. Perhaps above all it will help bridge differences of understanding between family members, thus helping to avoid the biggest risk of all.