Stonehage Fleming partners with Thrive Jersey to support “GROW” initiative

Stonehage Fleming is pleased to announce its partnership with Thrive Jersey to support GROW, a community-led initiative aimed at addressing multiple social issues that drive low mood and disengagement within the Jersey community.

GROW is an inclusive outdoor community project that plants, nurtures and harvests the widest array of fresh produce to be distributed to those on the island who do not have ready access to nutritional food. It provides innovative wellbeing, education and employment opportunities within an outdoor environment, whilst championing issues such as climate change, sustainable transport and community nutritional deficit. Thrive Jersey’s ethos is based on a collaborative approach to resolving community issues and in time aims to be mapped through initiatives including the United Nations Sustainable Development Goals (UN SDGs), and GROW aligns to no fewer than eleven of the seventeen goals.

According to the Jersey Statistics Unit approximately 26% of all households and 23% of individuals were in relative low income, including over half of single parent families, one in three working-age adults, one in three children and one in three pensioners1. This has a direct impact on the affordability of fresh fruit and vegetables which in turn leads to poor physical health, obesity and low self-esteem.

Guy Gilson, Partner at Stonehage Fleming said: “We are delighted to support Thrive Jersey’s GROW initiative and its mission to demonstrate how community, parishes and government can join together to implement inspiring and inclusive solutions to social issues. It is a pleasure to support such a worthy cause, and one which resonates so well with Stonehage Fleming’s social capital. We commend Andy on his vision for the welfare of those on the island.”

Andy Le Seelleur, Co-Founder of Thrive Jersey: “Jersey is facing an unprecedented crossroads in social development as a result of a number of internal and external threats including climate change, population growth, physical and mental health, Covid-19, reductions in agricultural green space and nutritional deficits within the lower socio-economic demographic. For many whose mood is low, the priority is more on surviving than thriving. GROW is an innovative project aimed at tackling Jersey’s social issues and we thank Stonehage Fleming for all their support to help influence positive change.”

1 - Jersey Statistics Unit - https://www.gov.je/Government/JerseyInFigures/EmploymentEarnings/Pages/EarningsIncomeStatistics.aspx

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

MEDIA CONTACTS

Montfort Communications

Pippa Bailey

+44 (0)20 3770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP60bn (USD55bn) of assets and includes an investment business with more than GBP16bn (USD21bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 900 people in 16 locations around the world. Find out more at: www.stonehagefleming.com .

Statistics as at end of December 2021

Thrive Jersey

Thrive Jersey was formed in 2019 and became an Incorporated Association in 2021. It is a fully-inclusive collective of inspiring individuals passionate about identifying the key social issues that drive low mood and disengagement within the island, raising awareness of these issues and seeking innovative, inspirational solutions. Having adopted the United Nations Sustainable Development Goals as its overarching strategy, Thrive is able to harness the powers of a common global community passionate about positive change in a smart, innovative way. Thrive Jersey focuses on addressing the root cause of social issues rather than simply fighting the fires and achieves this by:

- Identifying which social issues are having the largest impact on community mood and wellbeing

- Linking with other similar community innovators around the world to identify potential solutions which have a proven track record of success

- Harnessing inspirational, creative islanders to join together in collaborative initiatives, reducing silo thinking and operating and maximizing effectiveness.

Thrive has become a widely-recognised brand in Jersey and has played a fundamental role in the creation of the Jersey Suicide Prevention Alliance. Other pipeline initiatives include the creation of a community data portal and a centre for practical community skills development. Thrive’s founders have been responsible for successful community initiatives including Le Tournoi Charity Sports, Wetwheels Jersey and the Jersey Literary Festival. The GROW team includes the Founder of Plastic Free Jersey and The Good Jersey Life.

Stonehage Fleming announces completion of acquisition of private client services business of Maitland

01 Feb 2022

Stonehage Fleming announces completion of acquisition of private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the completion of its acquisition of the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm. The transaction was announced on 21 July 2021.

Maitland’s Private Client Services business is now part of Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services in 9 locations internationally. The transaction adds £1bn of AUM and £15bn of AUA, taking Stonehage Fleming’s AUM to over £16bn and AUA to over £60bn.

Chris Merry, Stonehage Fleming Group CEO commented: “We are excited to welcome the Maitland Private Client Services team and their clients to Stonehage Fleming. Making selected acquisitions to enhance our proposition alongside organic growth is part of our strategic plan; we will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

ENDS

MEDIA CONTACTS

UK / Europe - Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 7798 626282 / +44 7738 912267

South Africa - CDcom

Claire Densham / Lucie Osman

claire@cdcom.co.za / lucie@cdcom.co.za

+27 21 552 9935 / +27 21 813 6546

NOTES TO EDITORS:

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP60bn (USD75bn) of assets and includes an investment business with more than GBP16bn (USD20bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 900 people in 14 locations around the world. Find out more at: www.stonehagefleming.com .

Statistics as at 1 February 2022

Stonehage Fleming expands the US family office team

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the appointment of Joshua Runyan to further expand its Family Office team in the US.

Joshua is an experienced practicing attorney, focused on the U.S. and international tax planning. At Stonehage Fleming he will assist individuals and families regarding United States tax planning, closely held business succession planning, intergenerational wealth transfers, planned charitable giving, and tax controversy representation.

Prior to joining the Group, he practiced law at Montgomery, McCracken, Walker & Rhoads LLP and served as a member of the firm’s Benefits Committee. Before this, Josh was an accomplished journalist, working as senior editorial director of a regional publishing firm and editor-in-chief of several publications.

The appointment was effective from 13 September 2021. Joshua will be based in the Philadelphia office and report to Peter Rosenberg, Head of North America.

Peter Rosenberg, Partner & Head of North America, Stonehage Fleming said:

“Joshua will bring new experience and exciting networking opportunities to our US team, as we continue to grow our reach and opportunities provided to US residents who are seeking tailored and unique wealth management solutions. The growth of the team reflects our commitment to giving on the ground relationship management advice to our clients, both current and future, and strengthens our opportunities based across the US and Canada.”

ENDS

MEDIA CONTACTS

UK / Europe

Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 203 770 7913 / +44 7798 626282

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP15.2bn (USD21bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Statistics as at end of July 2021

Stonehage Fleming bolsters North American team with appointment of Partner as Head of Family Office

05 Oct 2021

Stonehage Fleming bolsters North American team with appointment of Partner as Head of Family Office

Stonehage Fleming (“stonehage fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the appointment of Johan van Niekerk to the newly created position of Head of Family Office (US).

Johan joined Stonehage Fleming in 2007 and, prior to his new appointment, served as Partner and Head of Family Office (Neuchatel, Switzerland). Johan’s main focus will be to further develop Stonehage Fleming’s Family Office offering in North America so that it reflects the comprehensive service available in the eight other jurisdictions where Stonehage Fleming operates.

The appointment is effective from 1 September 2021. Johan will be based in the Philadelphia office and report to Peter Rosenberg, Head of North America.

Chris Merry, Group Chief Executive Officer, Stonehage Fleming said: “We are pleased to announce Johan’s appointment as Head of Family Office (US). Johan is an important addition to our US team to support our growth ambitions in North America. We are committed to providing on the ground relationship management to current and future clients in the US and Canada and to providing holistic cross border advice to international families with interests in North America, which is a key strategic location for our business.”

Peter Rosenberg, Partner & Head of North America, Stonehage Fleming added: “I am excited to welcome Johan to the US team as we seek to broaden our reach to US residents looking for access to tailored wealth management solutions for their cross-border needs and objectives.”

“In today’s complex world, many high net worth families need cross-border support to help simplify and coordinate their affairs, due to family members, assets, or business investments being spread across multiple jurisdictions. I strongly believe that Stonehage Fleming’s award-winning capabilities, cherished heritage as an international family office, and the practical wisdom we offer, will be welcomed and align well with the long-term interests of US resident clients.”

ENDS

MEDIA CONTACTS

UK / Europe

Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 203 770 7913 / +44 7798 626282

Stonehage Fleming partners with Thrive Jersey to support “GROW” initiative

Stonehage Fleming is pleased to announce its partnership with Thrive Jersey to support GROW, a community-led initiative aimed at addressing multiple social issues that drive low mood and disengagement within the Jersey community.

GROW is an inclusive outdoor community project that plants, nurtures and harvests the widest array of fresh produce to be distributed to those on the island who do not have ready access to nutritional food. It provides innovative wellbeing, education and employment opportunities within an outdoor environment, whilst championing issues such as climate change, sustainable transport and community nutritional deficit. Thrive Jersey’s ethos is based on a collaborative approach to resolving community issues and in time aims to be mapped through initiatives including the United Nations Sustainable Development Goals (UN SDGs), and GROW aligns to no fewer than eleven of the seventeen goals.

According to the Jersey Statistics Unit approximately 26% of all households and 23% of individuals were in relative low income, including over half of single parent families, one in three working-age adults, one in three children and one in three pensioners1. This has a direct impact on the affordability of fresh fruit and vegetables which in turn leads to poor physical health, obesity and low self-esteem.

Guy Gilson, Partner at Stonehage Fleming said: “We are delighted to support Thrive Jersey’s GROW initiative and its mission to demonstrate how community, parishes and government can join together to implement inspiring and inclusive solutions to social issues. It is a pleasure to support such a worthy cause, and one which resonates so well with Stonehage Fleming’s social capital. We commend Andy on his vision for the welfare of those on the island.”

Andy Le Seelleur, Co-Founder of Thrive Jersey: “Jersey is facing an unprecedented crossroads in social development as a result of a number of internal and external threats including climate change, population growth, physical and mental health, Covid-19, reductions in agricultural green space and nutritional deficits within the lower socio-economic demographic. For many whose mood is low, the priority is more on surviving than thriving. GROW is an innovative project aimed at tackling Jersey’s social issues and we thank Stonehage Fleming for all their support to help influence positive change.”

1 - Jersey Statistics Unit - https://www.gov.je/Government/JerseyInFigures/EmploymentEarnings/Pages/EarningsIncomeStatistics.aspx

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

MEDIA CONTACTS

Montfort Communications

Pippa Bailey

+44 (0)20 3770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP60bn (USD55bn) of assets and includes an investment business with more than GBP16bn (USD21bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 900 people in 16 locations around the world. Find out more at: www.stonehagefleming.com .

Statistics as at end of December 2021

Thrive Jersey

Thrive Jersey was formed in 2019 and became an Incorporated Association in 2021. It is a fully-inclusive collective of inspiring individuals passionate about identifying the key social issues that drive low mood and disengagement within the island, raising awareness of these issues and seeking innovative, inspirational solutions. Having adopted the United Nations Sustainable Development Goals as its overarching strategy, Thrive is able to harness the powers of a common global community passionate about positive change in a smart, innovative way. Thrive Jersey focuses on addressing the root cause of social issues rather than simply fighting the fires and achieves this by:

- Identifying which social issues are having the largest impact on community mood and wellbeing

- Linking with other similar community innovators around the world to identify potential solutions which have a proven track record of success

- Harnessing inspirational, creative islanders to join together in collaborative initiatives, reducing silo thinking and operating and maximizing effectiveness.

Thrive has become a widely-recognised brand in Jersey and has played a fundamental role in the creation of the Jersey Suicide Prevention Alliance. Other pipeline initiatives include the creation of a community data portal and a centre for practical community skills development. Thrive’s founders have been responsible for successful community initiatives including Le Tournoi Charity Sports, Wetwheels Jersey and the Jersey Literary Festival. The GROW team includes the Founder of Plastic Free Jersey and The Good Jersey Life.

Stonehage Fleming announces completion of acquisition of private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the completion of its acquisition of the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm. The transaction was announced on 21 July 2021.

Maitland’s Private Client Services business is now part of Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services in 9 locations internationally. The transaction adds £1bn of AUM and £15bn of AUA, taking Stonehage Fleming’s AUM to over £16bn and AUA to over £60bn.

Chris Merry, Stonehage Fleming Group CEO commented: “We are excited to welcome the Maitland Private Client Services team and their clients to Stonehage Fleming. Making selected acquisitions to enhance our proposition alongside organic growth is part of our strategic plan; we will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

ENDS

MEDIA CONTACTS

UK / Europe - Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 7798 626282 / +44 7738 912267

South Africa - CDcom

Claire Densham / Lucie Osman

claire@cdcom.co.za / lucie@cdcom.co.za

+27 21 552 9935 / +27 21 813 6546

NOTES TO EDITORS:

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP60bn (USD75bn) of assets and includes an investment business with more than GBP16bn (USD20bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 900 people in 14 locations around the world. Find out more at: www.stonehagefleming.com .

Statistics as at 1 February 2022

Stonehage Fleming expands the US family office team

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the appointment of Joshua Runyan to further expand its Family Office team in the US.

Joshua is an experienced practicing attorney, focused on the U.S. and international tax planning. At Stonehage Fleming he will assist individuals and families regarding United States tax planning, closely held business succession planning, intergenerational wealth transfers, planned charitable giving, and tax controversy representation.

Prior to joining the Group, he practiced law at Montgomery, McCracken, Walker & Rhoads LLP and served as a member of the firm’s Benefits Committee. Before this, Josh was an accomplished journalist, working as senior editorial director of a regional publishing firm and editor-in-chief of several publications.

The appointment was effective from 13 September 2021. Joshua will be based in the Philadelphia office and report to Peter Rosenberg, Head of North America.

Peter Rosenberg, Partner & Head of North America, Stonehage Fleming said:

“Joshua will bring new experience and exciting networking opportunities to our US team, as we continue to grow our reach and opportunities provided to US residents who are seeking tailored and unique wealth management solutions. The growth of the team reflects our commitment to giving on the ground relationship management advice to our clients, both current and future, and strengthens our opportunities based across the US and Canada.”

ENDS

MEDIA CONTACTS

UK / Europe

Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 203 770 7913 / +44 7798 626282

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP15.2bn (USD21bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Statistics as at end of July 2021

Stonehage Fleming bolsters North American team with appointment of Partner as Head of Family Office

Stonehage Fleming (“stonehage fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces the appointment of Johan van Niekerk to the newly created position of Head of Family Office (US).

Johan joined Stonehage Fleming in 2007 and, prior to his new appointment, served as Partner and Head of Family Office (Neuchatel, Switzerland). Johan’s main focus will be to further develop Stonehage Fleming’s Family Office offering in North America so that it reflects the comprehensive service available in the eight other jurisdictions where Stonehage Fleming operates.

The appointment is effective from 1 September 2021. Johan will be based in the Philadelphia office and report to Peter Rosenberg, Head of North America.

Chris Merry, Group Chief Executive Officer, Stonehage Fleming said: “We are pleased to announce Johan’s appointment as Head of Family Office (US). Johan is an important addition to our US team to support our growth ambitions in North America. We are committed to providing on the ground relationship management to current and future clients in the US and Canada and to providing holistic cross border advice to international families with interests in North America, which is a key strategic location for our business.”

Peter Rosenberg, Partner & Head of North America, Stonehage Fleming added: “I am excited to welcome Johan to the US team as we seek to broaden our reach to US residents looking for access to tailored wealth management solutions for their cross-border needs and objectives.”

“In today’s complex world, many high net worth families need cross-border support to help simplify and coordinate their affairs, due to family members, assets, or business investments being spread across multiple jurisdictions. I strongly believe that Stonehage Fleming’s award-winning capabilities, cherished heritage as an international family office, and the practical wisdom we offer, will be welcomed and align well with the long-term interests of US resident clients.”

ENDS

MEDIA CONTACTS

UK / Europe

Montfort Communications

Gay Collins/ Pippa Bailey

stonehagefleming@montfort.london

+44 203 770 7913 / +44 7798 626282

Stonehage Fleming sign up to Women in Finance Charter

In 2021, we signed up to HM Treasury’s Women in Finance Charter. We are committed to the principles of the Charter to see gender balance at all levels across financial services firms.

Experience has shown us that we can best serve the interest not only of our existing clients, but also of the next generation and future clients, by drawing on the insights, talents and judgements of a diverse workforce.

Our DE&I Mission Statement (updated in December 2023):

- Our people are our greatest asset. To ensure we look after our greatest asset, we want Stonehage Fleming to be a great place to work for everyone. We commit to creating and sustaining a work environment which is fair, equal, as well as inclusive. This can only be achieved if diversity is embedded within our culture from top to bottom, influencing what we do, with leaders who are accountable.

- We strive for a culture of excellence and teamwork. For our people to excel and work together, everyone must feel that they are operating in an inclusive environment that welcomes and supports differences that encourages input from all perspectives. To achieve it, we will recruit, nurture and retain the best people, drawn from the broadest pool of individuals with a mix of backgrounds and experiences (nationality, origin, race, colour, religion, socioeconomic background, age, ability, sexual orientation and gender identity). Our people have the right to expect a workplace in which they are welcomed and valued by their team and by the Group.

- Clients are at the heart of our business. To continue providing creative ideas and solutions in a complex and global economy, we must be fully capable of dealing with diversity in an informed, sensitive and nuanced manner. Experience has shown us that we best serve the interest not only of our existing clients, but also of the next generation and future clients, by drawing on the insights, talents, and judgements of a diverse workforce.

Our Commitment to the Women in Finance Charter (updated in 2024):

- Our Group Executive Committee endorsed the signature of the Charter in 2021. Giuseppe Ciucci, Group Executive Chairman, is the lead sponsor of our Diversity, Equity and Inclusion Committee, which is chaired by Eva Sheppard, a senior Partner of the Group.

- Our internal targets for gender diversity have been constantly progressive. We achieved our targets to have 25% women in senior management positions by March 2023 and then 27.5% in 2024. Our new target is 30% by July 2026.

- Our commitment to improve diversity will include the evaluation of the senior leadership team against this objective.

- We commit to publishing our progress annually against these targets on our website.

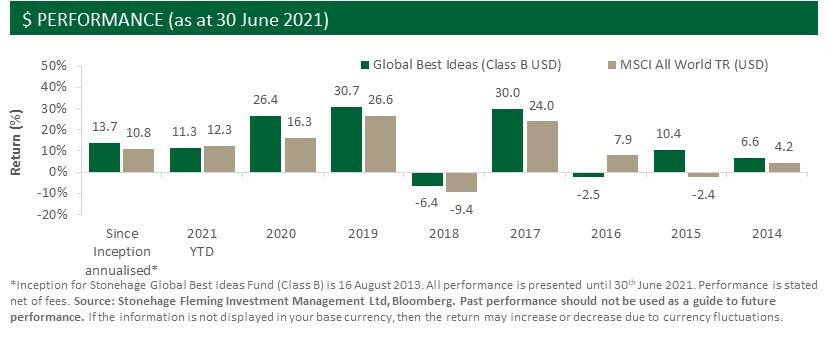

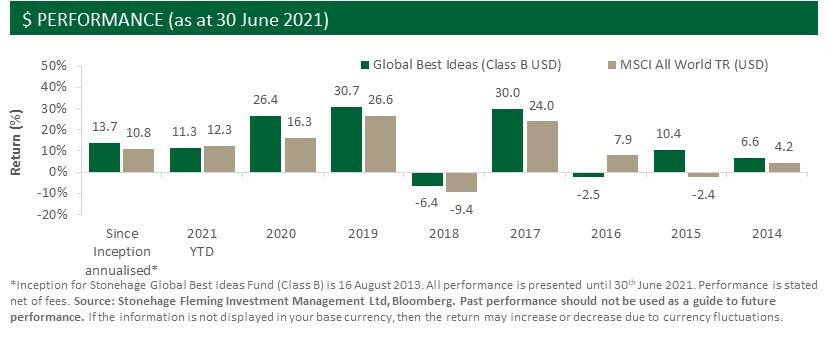

Stonehage Fleming’s flagship fund passes the $2bn mark

Assets under management (“AUM”) for the Stonehage Fleming Global Best Ideas Equity Fund have passed the USD2bn mark.

Since launching in August 2013, the fund has attracted assets from private, professional and institutional investors. It has returned 118.8% (17.0% p.a.)* over the last five years, compared to the MSCI World’s 97.8% (14.6% p.a.)** (US $ terms)***.

* Source: Stonehage Fleming Investment Management Ltd (SFIM), for period 1 July 2016 to 30 June 2021 (Stonehage Fleming Global Best Ideas Equity Fund (D Share Class) Factsheet).

** Source: MSCI World All Country $ TR, for period 1 July 2016 to 30 June 2021. Source: Bloomberg, MSCI.

*** Past performance is not a guide of future returns. If the information is not displayed in your base currency, then the return may increase or decrease due to currency fluctuations.

Fund Manager Gerrit Smit manages a concentrated, high conviction portfolio of 28 businesses that are chosen for their sustainable growth potential, strong management team, strategic competitive edge and value. The portfolio has very low turnover: over the past 12 months Gerrit has only sold two positions, with the fund turnover well below 10%. Current investments include some of the world’s best known companies such as Amazon, PayPal, Microsoft, Nike, Adobe and Estée Lauder.

Commenting on the current market environment, Gerrit Smit said: “The global fundamental economic recovery for 2021 is well underway, coming off the low base of 2020. We believe we are now into a new positive global economic cycle, well supported by the successful vaccine roll out programmes.”

“Some investors are challenged with perceptions of high valuations. They often underestimate the value of sustainable growth and get overwhelmed by current valuation multiples. The best opportunities lie in strategic investing with an eye on the horizon for long-term compounded growth, combined with an improving short-term outlook.”

Andrew Clarke, Group Head of Business Development said: “In under two years, our Global Best Ideas Equity Fund has doubled in size to exceed 2bn USD. The investment philosophy that underpins the Fund’s strategy, (i.e. that a good business remains a good business irrespective of short-term share price volatility), clearly resonates with investors.

We are excited by the Fund’s growth potential and look forward to raise the Fund’s profile further amongst wholesale investors this year.”

On the continuing impact of Covid-19, Gerrit Smit adds: “PayPal and Amazon (and many others’) futures are in the process of arriving two or more years early, without all the usual necessary investment required to attract all those new clients. Their future profitability therefore also arrives earlier, and their share prices have to reflect that. We believe their future growth trajectory has been enhanced by COVID-19.”

“Whilst the high street is structurally damaged, those businesses that have developed their online capabilities well are in the process of taking permanent market share. They should also enjoy better margins, with direct sales replacing those through wholesalers and retailers.”

Disclaimer:

We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision. Past performance is not a reliable indicator of future results and investments may go down as well as up. All investments risk the loss of capital. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. Where an investment is denominated in a currency other than the currency where the investor is resident, investment returns may increase or decrease as a result of currency fluctuations. The distribution or possession of this article in certain jurisdictions may be restricted by law or other regulatory requirements. Persons into whose possession this document comes should inform themselves about and observe any applicable legal and regulatory requirements.

It has been approved for issue by Stonehage Fleming Investment Management Limited, a company authorised and regulated in the UK by the Financial Conduct Authority and in South Africa by the Financial Sector Conduct Authority (FSP 46194).

Affiliates of Stonehage Fleming Investment Management Limited are authorised and regulated in Jersey by the Jersey Financial Services Commission for financial services business. This document has been approved for use in Jersey.

© Copyright Stonehage Fleming 2021. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming acquires private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces that it has agreed to acquire the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm.

On completion of the transaction, which is subject to regulatory approval in a number of jurisdictions, the business will transfer to Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services capability in 9 locations worldwide. The transaction will add £1 bn of AUM and £15 bn of AUA, taking Stonehage Fleming’s AUM to over £16 bn and AUA to over £60 bn.

Maitland’s Private Client Services business will bring further scale to Stonehage Fleming, strengthen key service areas and broaden the range of jurisdictions offered to clients. It will be combined with and operate under the Stonehage Fleming brand.

Three members of Maitland Group’s management team will join Stonehage Fleming, including Herman Troskie, currently Deputy CEO of Maitland, who will head a new Corporate, Legal and Tax Advisory Services Division at Stonehage Fleming and join the Group’s Executive Committee.

Chris Merry, Stonehage Fleming Group CEO commented: “This is an exciting time for Stonehage Fleming; we have the scale, the range of services and practical wisdom developed over many years to be the partner of choice for successful families and wealth creators. We have known and admired Maitland’s Private Client Services business for many years and are looking forward to welcoming their management, people and clients to Stonehage Fleming.

“For Stonehage Fleming, making selected acquisitions to enhance our proposition and increase our scale as a complement to organic growth is part of our strategic plan. We will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

Steve Georgala, CEO of Maitland commented “This transaction is a key step in the refinement of Maitland’s services offering which is now dedicated to Fund Services and Management Company Services. Such a transaction has been under consideration for some time and Stonehage Fleming has always been our preferred partner. We are confident that this acquisition will provide an excellent home for both our clients and our people who will thrive within a highly regarded global firm focused on the needs of Private Clients.”

Stonehage Fleming was advised on the transaction by Stonehage Fleming Corporate Finance.

FOR FURTHER INFORMATION, PLEASE CONTACT

Stonehage Fleming UK agency: Montfort Communications

Gay Collins/ Pippa Bailey - stonehagefleming@montfort.london

T +44 203 770 7913 M +44 7798 626282

Stonehage Fleming SA agency: CDcom

Claire Densham - claire@cdcom.co.za

T +27 21 552 9935

M +27 82 906 3201

Lucie Osman - lucie@cdcom.co.za

T +27 21 813 6546

M +27 76 763 8259

Maitland UK agency: Aspectus PR

Ellie Smith - maitland@aspectusgroup.com

T +44 20 7242 8867

Maitland SA media contact: Lucy Reyburn

Lucy Reyburn - lucy@lucyreyburn.com

T +27 82 922 7483

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Maitland is a global advisory and administration firm providing seamless multi-jurisdictional legal, tax, fiduciary, investment and fund administration services to private, corporate and institutional clients.

The Group specialise in complex, cross-border solutions, with 780 employees operating from 11 offices across 8 jurisdictions. They are privately owned and fully independent, administering funds for multiple investment managers and sponsors.

Maitland’s reputation in services to corporate clients extends back over 40 years to 1976 when the firm was founded in Luxembourg to provide innovative solutions to complex cross border challenges faced by major corporations. Over the years their legal experts have advised on some of the world’s leading corporate activity, involving both listed and unlisted companies.

Statistics as at end of March 2021

Stonehage Fleming launches first Global Sustainable Equity Fund

Stonehage Fleming Investment Management (“SFIM”) the investment division of one of the world’s leading international Family Offices, announces the launch of its Global Sustainable Equity Fund (“GSEF” or “the Fund”) having successfully launched its Global Sustainable Investment Portfolios (“GSIP”) in 2019.

The Fund will replicate the equity component of GSIP, which has returned 39.42% for the 19 months ending 30th April 2021 versus the global equity benchmark, MSCI ACWI at +23.04% (GBP).

Since launch, the Fund has already attracted over $106 million in assets from private and professional investors demonstrating clear demand for global sustainable equity strategies.

Mona Shah, Director at Stonehage Fleming Investment Management, says: “We strongly believe that today’s portfolio returns should not be at the expense of future generations. The outlook for ESG strategies today is more interesting than at the start of 2020 and we have seen increased appetite for this approach as clients actively seek to demonstrate their social capital in their investment philosophy and measure their positive contribution. By launching the Global Sustainable Equity Fund, we are going some way to meet their demands.”

Graham Wainer, Chief Executive Officer and Head of Investments at Stonehage Fleming Investment Management, adds: “We made the decision that this, our first standalone sustainable investment fund, should be focused solely on equity investments as we see them as the key drivers of return. Our equity investments can tackle a breadth of issues, including building back from Covid-19 and helping to address the majority of the UN’s Sustainable Development Goals. We can also measure and report the impact that our clients’ investments make towards creating a sustainable planet and society.”

Guy Hudson, Partner and Head of Group Marketing at Stonehage Fleming, said: “Our published proprietary research, ‘The Four Pillars of Capital: A time for reflection’ (2020) found that ultra-high net worth families and wealth creators have remained committed to ESG investment, despite the impact of COVID-19. 83% of respondents that applied ESG principles to their investments had not wavered from this, even as the pandemic caused turbulence in markets in the first half of 2020.”

Shah concludes: “Government spending towards the green economy has never been so strong, and the run up to COP26 in November could create a platform for further policy support. Our Global Sustainable Equity Fund is well placed to capture this momentum as well as investment into other social issues, including education and gender equality.”

The Global Sustainable Equity Fund is now available. Further details can be found here: www.stonehagefleming.com/investments/esg

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland / Pippa Bailey

T +44 (0)203 770 7907 / 44 (0)203 770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world.

Statistics as at end of March 2021

This is a financial promotion issued by Stonehage Fleming Investment Management Limited (SFIM) which is authorised and regulated by the Financial Conduct Authority (194382) and by the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No: 46194). The Fund is an approved Foreign Collective Investment Scheme in South Africa and the Management Company, Stonehage Fleming Partners Pooled Investments (Ireland) plc, is registered under the Collective Investment Schemes Control Act, 2002

Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for investment business by the JFSC.

All investments risk the loss of capital.

Past performance is not a guide to future performance.

The Fund intends to invest predominantly in a range of underlying collective investment schemes. Please refer to the prospectus for details of the investment policy.

GSEF has been approved for launch in a limited number of jurisdictions. Before investing you should ensure that the rules in your jurisdiction allow you to buy shares in the Fund.

Stonehage Fleming sign up to Women in Finance Charter

In 2021, we signed up to HM Treasury’s Women in Finance Charter. We are committed to the principles of the Charter to see gender balance at all levels across financial services firms.

Experience has shown us that we can best serve the interest not only of our existing clients, but also of the next generation and future clients, by drawing on the insights, talents and judgements of a diverse workforce.

Our DE&I Mission Statement (updated in December 2023):

- Our people are our greatest asset. To ensure we look after our greatest asset, we want Stonehage Fleming to be a great place to work for everyone. We commit to creating and sustaining a work environment which is fair, equal, as well as inclusive. This can only be achieved if diversity is embedded within our culture from top to bottom, influencing what we do, with leaders who are accountable.

- We strive for a culture of excellence and teamwork. For our people to excel and work together, everyone must feel that they are operating in an inclusive environment that welcomes and supports differences that encourages input from all perspectives. To achieve it, we will recruit, nurture and retain the best people, drawn from the broadest pool of individuals with a mix of backgrounds and experiences (nationality, origin, race, colour, religion, socioeconomic background, age, ability, sexual orientation and gender identity). Our people have the right to expect a workplace in which they are welcomed and valued by their team and by the Group.

- Clients are at the heart of our business. To continue providing creative ideas and solutions in a complex and global economy, we must be fully capable of dealing with diversity in an informed, sensitive and nuanced manner. Experience has shown us that we best serve the interest not only of our existing clients, but also of the next generation and future clients, by drawing on the insights, talents, and judgements of a diverse workforce.

Our Commitment to the Women in Finance Charter (updated in 2024):

- Our Group Executive Committee endorsed the signature of the Charter in 2021. Giuseppe Ciucci, Group Executive Chairman, is the lead sponsor of our Diversity, Equity and Inclusion Committee, which is chaired by Eva Sheppard, a senior Partner of the Group.

- Our internal targets for gender diversity have been constantly progressive. We achieved our targets to have 25% women in senior management positions by March 2023 and then 27.5% in 2024. Our new target is 30% by July 2026.

- Our commitment to improve diversity will include the evaluation of the senior leadership team against this objective.

- We commit to publishing our progress annually against these targets on our website.

Stonehage Fleming’s flagship fund passes the $2bn mark

Assets under management (“AUM”) for the Stonehage Fleming Global Best Ideas Equity Fund have passed the USD2bn mark.

Since launching in August 2013, the fund has attracted assets from private, professional and institutional investors. It has returned 118.8% (17.0% p.a.)* over the last five years, compared to the MSCI World’s 97.8% (14.6% p.a.)** (US $ terms)***.

* Source: Stonehage Fleming Investment Management Ltd (SFIM), for period 1 July 2016 to 30 June 2021 (Stonehage Fleming Global Best Ideas Equity Fund (D Share Class) Factsheet).

** Source: MSCI World All Country $ TR, for period 1 July 2016 to 30 June 2021. Source: Bloomberg, MSCI.

*** Past performance is not a guide of future returns. If the information is not displayed in your base currency, then the return may increase or decrease due to currency fluctuations.

Fund Manager Gerrit Smit manages a concentrated, high conviction portfolio of 28 businesses that are chosen for their sustainable growth potential, strong management team, strategic competitive edge and value. The portfolio has very low turnover: over the past 12 months Gerrit has only sold two positions, with the fund turnover well below 10%. Current investments include some of the world’s best known companies such as Amazon, PayPal, Microsoft, Nike, Adobe and Estée Lauder.

Commenting on the current market environment, Gerrit Smit said: “The global fundamental economic recovery for 2021 is well underway, coming off the low base of 2020. We believe we are now into a new positive global economic cycle, well supported by the successful vaccine roll out programmes.”

“Some investors are challenged with perceptions of high valuations. They often underestimate the value of sustainable growth and get overwhelmed by current valuation multiples. The best opportunities lie in strategic investing with an eye on the horizon for long-term compounded growth, combined with an improving short-term outlook.”

Andrew Clarke, Group Head of Business Development said: “In under two years, our Global Best Ideas Equity Fund has doubled in size to exceed 2bn USD. The investment philosophy that underpins the Fund’s strategy, (i.e. that a good business remains a good business irrespective of short-term share price volatility), clearly resonates with investors.

We are excited by the Fund’s growth potential and look forward to raise the Fund’s profile further amongst wholesale investors this year.”

On the continuing impact of Covid-19, Gerrit Smit adds: “PayPal and Amazon (and many others’) futures are in the process of arriving two or more years early, without all the usual necessary investment required to attract all those new clients. Their future profitability therefore also arrives earlier, and their share prices have to reflect that. We believe their future growth trajectory has been enhanced by COVID-19.”

“Whilst the high street is structurally damaged, those businesses that have developed their online capabilities well are in the process of taking permanent market share. They should also enjoy better margins, with direct sales replacing those through wholesalers and retailers.”

Disclaimer:

We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision. Past performance is not a reliable indicator of future results and investments may go down as well as up. All investments risk the loss of capital. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes. Where an investment is denominated in a currency other than the currency where the investor is resident, investment returns may increase or decrease as a result of currency fluctuations. The distribution or possession of this article in certain jurisdictions may be restricted by law or other regulatory requirements. Persons into whose possession this document comes should inform themselves about and observe any applicable legal and regulatory requirements.

It has been approved for issue by Stonehage Fleming Investment Management Limited, a company authorised and regulated in the UK by the Financial Conduct Authority and in South Africa by the Financial Sector Conduct Authority (FSP 46194).

Affiliates of Stonehage Fleming Investment Management Limited are authorised and regulated in Jersey by the Jersey Financial Services Commission for financial services business. This document has been approved for use in Jersey.

© Copyright Stonehage Fleming 2021. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior written permission.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming acquires private client services business of Maitland

Stonehage Fleming (“Stonehage Fleming” or “the Group”), the leading independently owned international Multi Family Office, today announces that it has agreed to acquire the Private Client Services business of Maitland, a privately owned global advisory, administration and family office firm.

On completion of the transaction, which is subject to regulatory approval in a number of jurisdictions, the business will transfer to Stonehage Fleming, bringing legal, fiduciary, corporate and investment management services capability in 9 locations worldwide. The transaction will add £1 bn of AUM and £15 bn of AUA, taking Stonehage Fleming’s AUM to over £16 bn and AUA to over £60 bn.

Maitland’s Private Client Services business will bring further scale to Stonehage Fleming, strengthen key service areas and broaden the range of jurisdictions offered to clients. It will be combined with and operate under the Stonehage Fleming brand.

Three members of Maitland Group’s management team will join Stonehage Fleming, including Herman Troskie, currently Deputy CEO of Maitland, who will head a new Corporate, Legal and Tax Advisory Services Division at Stonehage Fleming and join the Group’s Executive Committee.

Chris Merry, Stonehage Fleming Group CEO commented: “This is an exciting time for Stonehage Fleming; we have the scale, the range of services and practical wisdom developed over many years to be the partner of choice for successful families and wealth creators. We have known and admired Maitland’s Private Client Services business for many years and are looking forward to welcoming their management, people and clients to Stonehage Fleming.

“For Stonehage Fleming, making selected acquisitions to enhance our proposition and increase our scale as a complement to organic growth is part of our strategic plan. We will continue to look for more opportunities to complement our existing business and bring our differentiated and comprehensive offering to new clients.”

Steve Georgala, CEO of Maitland commented “This transaction is a key step in the refinement of Maitland’s services offering which is now dedicated to Fund Services and Management Company Services. Such a transaction has been under consideration for some time and Stonehage Fleming has always been our preferred partner. We are confident that this acquisition will provide an excellent home for both our clients and our people who will thrive within a highly regarded global firm focused on the needs of Private Clients.”

Stonehage Fleming was advised on the transaction by Stonehage Fleming Corporate Finance.

FOR FURTHER INFORMATION, PLEASE CONTACT

Stonehage Fleming UK agency: Montfort Communications

Gay Collins/ Pippa Bailey - stonehagefleming@montfort.london

T +44 203 770 7913 M +44 7798 626282

Stonehage Fleming SA agency: CDcom

Claire Densham - claire@cdcom.co.za

T +27 21 552 9935

M +27 82 906 3201

Lucie Osman - lucie@cdcom.co.za

T +27 21 813 6546

M +27 76 763 8259

Maitland UK agency: Aspectus PR

Ellie Smith - maitland@aspectusgroup.com

T +44 20 7242 8867

Maitland SA media contact: Lucy Reyburn

Lucy Reyburn - lucy@lucyreyburn.com

T +27 82 922 7483

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned multi- family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world. Find out more at: www.stonehagefleming.com

Maitland is a global advisory and administration firm providing seamless multi-jurisdictional legal, tax, fiduciary, investment and fund administration services to private, corporate and institutional clients.

The Group specialise in complex, cross-border solutions, with 780 employees operating from 11 offices across 8 jurisdictions. They are privately owned and fully independent, administering funds for multiple investment managers and sponsors.

Maitland’s reputation in services to corporate clients extends back over 40 years to 1976 when the firm was founded in Luxembourg to provide innovative solutions to complex cross border challenges faced by major corporations. Over the years their legal experts have advised on some of the world’s leading corporate activity, involving both listed and unlisted companies.

Statistics as at end of March 2021

Stonehage Fleming launches first Global Sustainable Equity Fund

Stonehage Fleming Investment Management (“SFIM”) the investment division of one of the world’s leading international Family Offices, announces the launch of its Global Sustainable Equity Fund (“GSEF” or “the Fund”) having successfully launched its Global Sustainable Investment Portfolios (“GSIP”) in 2019.

The Fund will replicate the equity component of GSIP, which has returned 39.42% for the 19 months ending 30th April 2021 versus the global equity benchmark, MSCI ACWI at +23.04% (GBP).

Since launch, the Fund has already attracted over $106 million in assets from private and professional investors demonstrating clear demand for global sustainable equity strategies.

Mona Shah, Director at Stonehage Fleming Investment Management, says: “We strongly believe that today’s portfolio returns should not be at the expense of future generations. The outlook for ESG strategies today is more interesting than at the start of 2020 and we have seen increased appetite for this approach as clients actively seek to demonstrate their social capital in their investment philosophy and measure their positive contribution. By launching the Global Sustainable Equity Fund, we are going some way to meet their demands.”

Graham Wainer, Chief Executive Officer and Head of Investments at Stonehage Fleming Investment Management, adds: “We made the decision that this, our first standalone sustainable investment fund, should be focused solely on equity investments as we see them as the key drivers of return. Our equity investments can tackle a breadth of issues, including building back from Covid-19 and helping to address the majority of the UN’s Sustainable Development Goals. We can also measure and report the impact that our clients’ investments make towards creating a sustainable planet and society.”

Guy Hudson, Partner and Head of Group Marketing at Stonehage Fleming, said: “Our published proprietary research, ‘The Four Pillars of Capital: A time for reflection’ (2020) found that ultra-high net worth families and wealth creators have remained committed to ESG investment, despite the impact of COVID-19. 83% of respondents that applied ESG principles to their investments had not wavered from this, even as the pandemic caused turbulence in markets in the first half of 2020.”

Shah concludes: “Government spending towards the green economy has never been so strong, and the run up to COP26 in November could create a platform for further policy support. Our Global Sustainable Equity Fund is well placed to capture this momentum as well as investment into other social issues, including education and gender equality.”

The Global Sustainable Equity Fund is now available. Further details can be found here: www.stonehagefleming.com/investments/esg

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland / Pippa Bailey

T +44 (0)203 770 7907 / 44 (0)203 770 7913

stonehagefleming@montfort.london

NOTES TO EDITORS

Stonehage Fleming is one of the world’s leading independently owned family offices and the largest in Europe, Middle East and Africa (EMEA), as measured by its breadth of services, geographic reach and by assets under management, advice and administration.

Stonehage Fleming provides a range of services from long-term strategic planning and investments to day-to-day advice and administration to the world’s leading families and wealth creators. The Group advises on over GBP45bn (USD55bn) of assets and includes an investment business with more than GBP14.4bn (USD19.9bn) under management for families and charities. Stonehage Fleming is c.50% owned by management and staff. The Group employs over 600 people in 11 offices in eight geographies around the world.

Statistics as at end of March 2021

This is a financial promotion issued by Stonehage Fleming Investment Management Limited (SFIM) which is authorised and regulated by the Financial Conduct Authority (194382) and by the Financial Sector Conduct Authority (South Africa) as a Financial Services Provider (FSP No: 46194). The Fund is an approved Foreign Collective Investment Scheme in South Africa and the Management Company, Stonehage Fleming Partners Pooled Investments (Ireland) plc, is registered under the Collective Investment Schemes Control Act, 2002

Approved for distribution in Jersey by affiliates of Stonehage Fleming Investment Management that are regulated for investment business by the JFSC.

All investments risk the loss of capital.

Past performance is not a guide to future performance.

The Fund intends to invest predominantly in a range of underlying collective investment schemes. Please refer to the prospectus for details of the investment policy.

GSEF has been approved for launch in a limited number of jurisdictions. Before investing you should ensure that the rules in your jurisdiction allow you to buy shares in the Fund.

Stonehage Fleming appoints Head of Estate Planning in newly created role

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Hélie de Cornois as Director and Head of Estate Planning.

Hélie will be based in Stonehage Fleming’s Luxembourg office and will report into Jacqui Cheshire, Partner and Head of Family Office in Switzerland. He will advise ultra-high net worth private clients and investors on a range of domestic and international tax and estate planning matters. This is a newly created role and Hélie’s appointment is effective immediately.

Hélie has over 17 years’ experience in the estate planning industry. Prior to joining the Stonehage Fleming Group in 2021 he was Head of Estate Planning & International Patrimonial Services at Banque Degroof Petercam in Luxembourg, where he was responsible for the Estate Planning department. He was also responsible for coordinating International Estate Planning files for the group and for developing private banking in Southern Europe, Canada and UK. Hélie joined Banque Degroof Petercam in 2007 and held roles including Head of Wealth Structuring and Head of Corporate and Structured Finance in Luxembourg.

Hélie began his career in 2003 at Banque de Gestion Privée Indosuez (now CA Indosuez Wealth) in Paris as an estate planner. He is also a Member of the Society of Trust and Estate Practitioners (STEP) and the Luxembourg Private Equity and Venture Capital Association (LPEA).

Commenting on the appointment, Jacqui Cheshire, Partner and Head of Family Office in Switzerland said: “Continental Europe is a key market for us and so we are pleased to have attracted someone of Hélie’s calibre to bolster our Luxembourg team. This is a newly created role and underlines our commitment to the further growth of the business in Europe and to continually expanding our client service offering. I am delighted to welcome Hélie and look forward to working with him in the coming months.”

Hélie de Cornois said: “The pandemic prompted many people to reassess their plans and priorities – it was a catalyst to get their affairs in order. This is a growing trend and an ideal opportunity for me to help expand Stonehage Fleming’s existing expertise. I am looking forward to working with our families to help find the right solutions in what is a complex and ever evolving arena”.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

10 May 2021

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

Stonehage Fleming, l’un des plus grands Family Office indépendant au monde, annonce l’arrivée d’Hélie de Cornois au poste de Director et Head of Estate Planning.

Hélie sera rattaché au bureau de Stonehage Fleming situé au Luxembourg, et rapportera à Jacqui Cheshire, Partner et Head of Family Office en Suisse. Il accompagnera les clients et investisseurs ultra-high net worth sur des sujets d’organisation patrimoniale et de fiscalité nationale et internationale. La nomination d’Hélie à ce poste nouvellement créé est effective immédiatement.

Hélie a plus de 17 ans d’expérience dans le domaine de l’ingénierie patrimoniale. Avant de rejoindre le groupe Stonehage Fleming en 2021, il était Head of Estate Planning & International Patrimonial Services à la Banque Degroof Petercam au Luxembourg, où il avait la responsabilité du département d’ingénierie patrimoniale. Il était également en charge de la coordination des dossiers patrimoniaux internationaux pour le groupe et du développement de la Banque Privée en Europe du Sud, au Canada et au Royaume-Uni. Hélie a rejoint la Banque Degroof Petercam en 2007, où il a été notamment Head of Wealth Structuring et Head of Corporate & Strucured Finance au Luxembourg.

Hélie a commencé sa carrière en 2003, à la Banque de Gestion Privée Indosuez (maintenant CA Indosuez Wealth) à Paris, en tant qu’ingénieur patrimonial. Il est aussi membre de la Society of Trust and Estate Practitioners (STEP) et de la Luxembourg Private Equity and Venture Capital Association (LPEA).

Au sujet de cette nomination, Jacqui Cheshire, Partner et Head of Family Office en Suisse, ajoute : « L’Europe continentale est un marché clé pour nous et nous sommes donc ravis d'avoir attiré quelqu’un du calibre d’Hélie pour renforcer notre équipe au Luxembourg. Ce nouveau poste souligne notre volonté de nous développer en Europe et de continuellement compléter notre offre de services pour nos clients. Je suis heureuse d'accueillir Hélie et je me réjouis de collaborer avec lui dans les prochains mois. »

Hélie de Cornois précise : « La pandémie a incité beaucoup de gens à revoir leurs projets et leurs priorités ; elle a servi de catalyseur pour organiser leur patrimoine. C’est une tendance croissante qui m’offre l’opportunité de renforcer l’expertise existante de Stonehage Fleming. Je me réjouis de travailler avec nos familles pour les aider à identifier les solutions appropriées dans cet environnement complexe et évolutif ».

POUR EN SAVOIR PLUS, CONTACTEZ

Montfort Communications

Toto Reissland / Pippa Bailey

T : +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming announces appointment of Mario Schoeman

Mario will be responsible for leading the distribution of Stonehage Fleming’s global service offerings, including the award winning Global Best Ideas Equity fund into the South African investment market, directly as well as through the Feeder Fund. He will be based in Stonehage Fleming’s Cape Town office and will report into Andrew Clarke, Group Head of Business Development. His appointment is effective immediately.

Mario has more than two decades of local and international investment industry experience, ranging from fund research and investment product management to retail and institutional business development. He was Head of Retail Distribution at Foord Asset Management for the past 10 years and served on various committees at the Association for Savings & Investment South Africa. Prior to this he was with OMIGSA and STANLIB in executive positions. Mario holds a BSc degree from the University of Stellenbosch as well as a Masters degree in Business Leadership from the University of South Africa.

Commenting on the appointment, Andrew Clarke said: “The Global Best Ideas Equity investment strategy is already well established in South Africa, but we look forward to having a dedicated resource on the ground who has the primary responsibility of growing the AUM of this fund through the wholesale market. We are excited about Mario’s experience in the industry and the role he will play in the distribution of our other premier offerings in the local market. We are delighted to welcome him to the firm.”

Mario Schoeman said: “Stonehage Fleming’s reputation in the industry is flawless and I am honoured to join the team. I am very excited about the team’s capabilities, evidenced in the track record of the GBI strategy and look forward to contribute to even more success.”

Stonehage Fleming announces series of new appointments in Jersey

Stonehage Fleming, one of the world’s leading international Family Offices, announces a series of appointments across its Family Office, Treasury and Corporate Services divisions in Jersey.

The eight new hires follow the recent announcement of Bev Stewart as Director in the Jersey Family Office division (November 2020) and cover various levels of seniority. New joiners include: Miguel Loureiro and Florence Busel in Family Office, Amber Thomas, Marta Szyman, Jarek Wolak and Matthew Bree in Treasury, and Jon Manning and Kay Jeanne in Corporate Services. They are all based in Stonehage Fleming’s Jersey office and their appointments are effective immediately.

The new appointments join an office of over 100 people, with nearly half of the partners having been at the firm for more than 20 years, and many of the senior team considered leading figures in their respective fields on the island.

Commenting on the appointment, Ana Ventura, Partner and Head of Family Office Jersey said: “We are thrilled to welcome so many new faces to our already extremely talented and dedicated team. These appointments reflect and confirm our drive to nurture talent and to provide unrivalled career development opportunities on the island.”

“As we celebrate International Women’s Day, it is equally exciting that we have hired some immensely promising female talent to join our existing group of women who we have supported through the firm’s ranks.”

Cora Binchy, Partner in Stonehage Fleming’s Family Office division said: “I am delighted to welcome everyone to Stonehage Fleming. I have been with the firm for over 30 years and am incredibly proud of the nurturing culture and career development opportunities Stonehage Fleming is able to provide. Likewise, a diverse workforce is essential for businesses and gender parity is a huge part of that. We have seen progress in this area but in a rapidly changing world, we need to accelerate so we are well positioned for the future. I look forward to working with our new colleagues.”

ENDS

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Pippa Bailey

T: +44 (0)203 770 7913

Stonehage Fleming appoints Head of Estate Planning in newly created role

Stonehage Fleming, one of the world’s leading international Family Offices, announces the appointment of Hélie de Cornois as Director and Head of Estate Planning.

Hélie will be based in Stonehage Fleming’s Luxembourg office and will report into Jacqui Cheshire, Partner and Head of Family Office in Switzerland. He will advise ultra-high net worth private clients and investors on a range of domestic and international tax and estate planning matters. This is a newly created role and Hélie’s appointment is effective immediately.

Hélie has over 17 years’ experience in the estate planning industry. Prior to joining the Stonehage Fleming Group in 2021 he was Head of Estate Planning & International Patrimonial Services at Banque Degroof Petercam in Luxembourg, where he was responsible for the Estate Planning department. He was also responsible for coordinating International Estate Planning files for the group and for developing private banking in Southern Europe, Canada and UK. Hélie joined Banque Degroof Petercam in 2007 and held roles including Head of Wealth Structuring and Head of Corporate and Structured Finance in Luxembourg.

Hélie began his career in 2003 at Banque de Gestion Privée Indosuez (now CA Indosuez Wealth) in Paris as an estate planner. He is also a Member of the Society of Trust and Estate Practitioners (STEP) and the Luxembourg Private Equity and Venture Capital Association (LPEA).

Commenting on the appointment, Jacqui Cheshire, Partner and Head of Family Office in Switzerland said: “Continental Europe is a key market for us and so we are pleased to have attracted someone of Hélie’s calibre to bolster our Luxembourg team. This is a newly created role and underlines our commitment to the further growth of the business in Europe and to continually expanding our client service offering. I am delighted to welcome Hélie and look forward to working with him in the coming months.”

Hélie de Cornois said: “The pandemic prompted many people to reassess their plans and priorities – it was a catalyst to get their affairs in order. This is a growing trend and an ideal opportunity for me to help expand Stonehage Fleming’s existing expertise. I am looking forward to working with our families to help find the right solutions in what is a complex and ever evolving arena”.

FOR FURTHER INFORMATION, PLEASE CONTACT

Montfort Communications

Toto Reissland/ Pippa Bailey

T: +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming nomme un responsable de l’ingenierie patrimoniale pour une fonction nouvellement creee

Stonehage Fleming, l’un des plus grands Family Office indépendant au monde, annonce l’arrivée d’Hélie de Cornois au poste de Director et Head of Estate Planning.

Hélie sera rattaché au bureau de Stonehage Fleming situé au Luxembourg, et rapportera à Jacqui Cheshire, Partner et Head of Family Office en Suisse. Il accompagnera les clients et investisseurs ultra-high net worth sur des sujets d’organisation patrimoniale et de fiscalité nationale et internationale. La nomination d’Hélie à ce poste nouvellement créé est effective immédiatement.

Hélie a plus de 17 ans d’expérience dans le domaine de l’ingénierie patrimoniale. Avant de rejoindre le groupe Stonehage Fleming en 2021, il était Head of Estate Planning & International Patrimonial Services à la Banque Degroof Petercam au Luxembourg, où il avait la responsabilité du département d’ingénierie patrimoniale. Il était également en charge de la coordination des dossiers patrimoniaux internationaux pour le groupe et du développement de la Banque Privée en Europe du Sud, au Canada et au Royaume-Uni. Hélie a rejoint la Banque Degroof Petercam en 2007, où il a été notamment Head of Wealth Structuring et Head of Corporate & Strucured Finance au Luxembourg.

Hélie a commencé sa carrière en 2003, à la Banque de Gestion Privée Indosuez (maintenant CA Indosuez Wealth) à Paris, en tant qu’ingénieur patrimonial. Il est aussi membre de la Society of Trust and Estate Practitioners (STEP) et de la Luxembourg Private Equity and Venture Capital Association (LPEA).

Au sujet de cette nomination, Jacqui Cheshire, Partner et Head of Family Office en Suisse, ajoute : « L’Europe continentale est un marché clé pour nous et nous sommes donc ravis d'avoir attiré quelqu’un du calibre d’Hélie pour renforcer notre équipe au Luxembourg. Ce nouveau poste souligne notre volonté de nous développer en Europe et de continuellement compléter notre offre de services pour nos clients. Je suis heureuse d'accueillir Hélie et je me réjouis de collaborer avec lui dans les prochains mois. »

Hélie de Cornois précise : « La pandémie a incité beaucoup de gens à revoir leurs projets et leurs priorités ; elle a servi de catalyseur pour organiser leur patrimoine. C’est une tendance croissante qui m’offre l’opportunité de renforcer l’expertise existante de Stonehage Fleming. Je me réjouis de travailler avec nos familles pour les aider à identifier les solutions appropriées dans cet environnement complexe et évolutif ».

POUR EN SAVOIR PLUS, CONTACTEZ

Montfort Communications

Toto Reissland / Pippa Bailey

T : +44 (0)20 3770 7907 / +44 (0)203 770 7913

Stonehage Fleming announces appointment of Mario Schoeman

Mario will be responsible for leading the distribution of Stonehage Fleming’s global service offerings, including the award winning Global Best Ideas Equity fund into the South African investment market, directly as well as through the Feeder Fund. He will be based in Stonehage Fleming’s Cape Town office and will report into Andrew Clarke, Group Head of Business Development. His appointment is effective immediately.

Mario has more than two decades of local and international investment industry experience, ranging from fund research and investment product management to retail and institutional business development. He was Head of Retail Distribution at Foord Asset Management for the past 10 years and served on various committees at the Association for Savings & Investment South Africa. Prior to this he was with OMIGSA and STANLIB in executive positions. Mario holds a BSc degree from the University of Stellenbosch as well as a Masters degree in Business Leadership from the University of South Africa.

Commenting on the appointment, Andrew Clarke said: “The Global Best Ideas Equity investment strategy is already well established in South Africa, but we look forward to having a dedicated resource on the ground who has the primary responsibility of growing the AUM of this fund through the wholesale market. We are excited about Mario’s experience in the industry and the role he will play in the distribution of our other premier offerings in the local market. We are delighted to welcome him to the firm.”

Mario Schoeman said: “Stonehage Fleming’s reputation in the industry is flawless and I am honoured to join the team. I am very excited about the team’s capabilities, evidenced in the track record of the GBI strategy and look forward to contribute to even more success.”

Stonehage Fleming announces series of new appointments in Jersey

Stonehage Fleming, one of the world’s leading international Family Offices, announces a series of appointments across its Family Office, Treasury and Corporate Services divisions in Jersey.

The eight new hires follow the recent announcement of Bev Stewart as Director in the Jersey Family Office division (November 2020) and cover various levels of seniority. New joiners include: Miguel Loureiro and Florence Busel in Family Office, Amber Thomas, Marta Szyman, Jarek Wolak and Matthew Bree in Treasury, and Jon Manning and Kay Jeanne in Corporate Services. They are all based in Stonehage Fleming’s Jersey office and their appointments are effective immediately.