Insights

Ask Our Virtual Panel: Part 1

Part 2 | Part 3 | Part 4 | Part 5

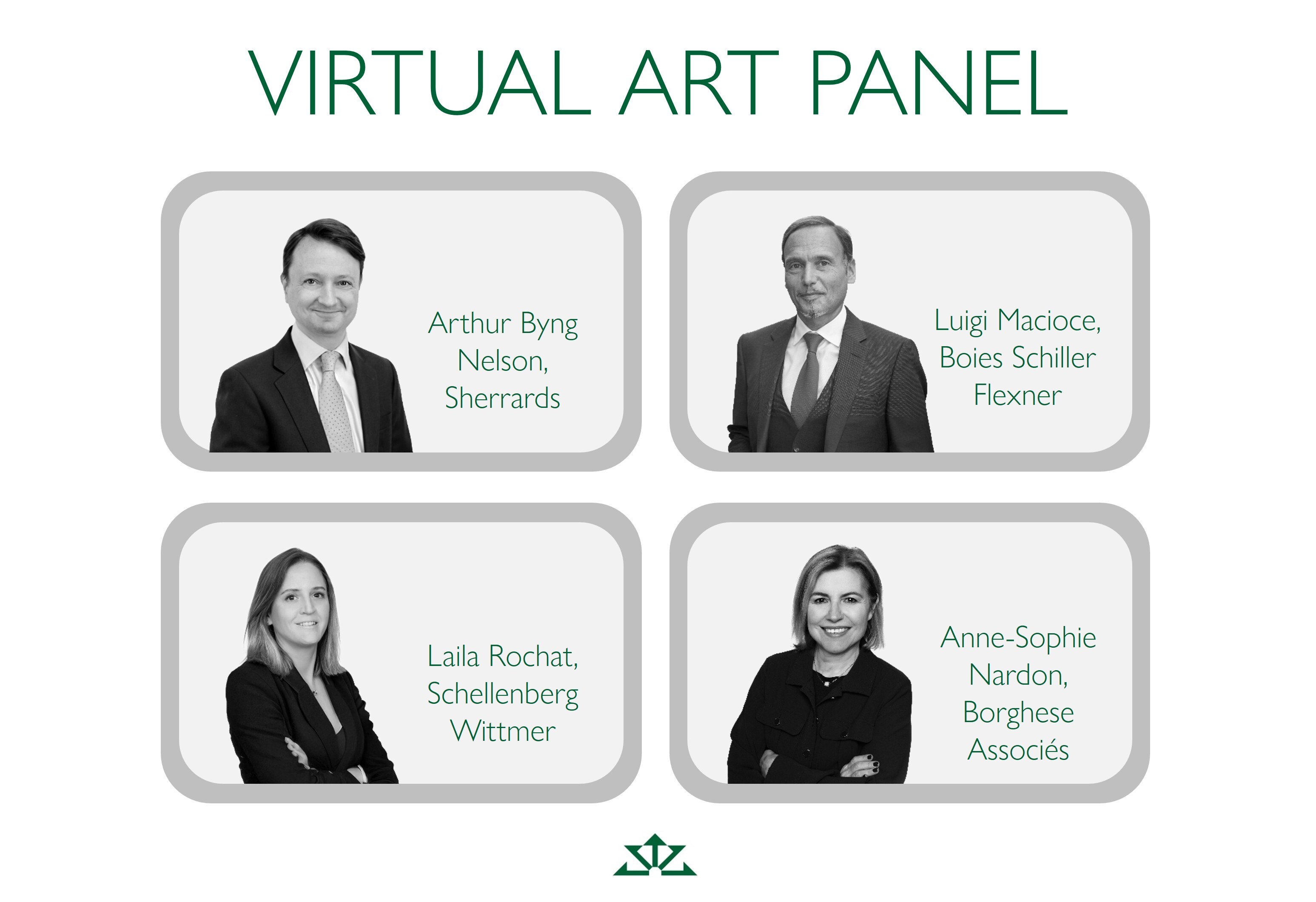

In this new series, we convened a 'virtual art panel' of external art law experts representing four different countries in Europe - UK, France, Italy, and Switzerland - to explain how their jurisdiction approaches key issues surrounding the acquisition and movement of art and cultural objects, and the various things you come up against when owning an art collection.

From taxes and legal frameworks to incentives that encourage the transfer of art, our panellists explore five distinct topics, each shedding light on how their respective countries handle each art-related matter.

In Part I of this series, we asked our 'virtual art panel' to explain how Gift Tax is handled in their respective countries, highlighting gifting to a charity, and available exemptions.

Disclaimer

All legal responses contained herein were obtained as at 07.11.2025

Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate by changes in applicable laws and regulations. For example, the levels and bases of taxation may change.

This information should not be considered as tax advice. Tax treatment depends upon individual circumstances and individuals should seek professional tax advice as necessary.

In the UK there is no Gift Tax, but donors should be aware of Inheritance Tax and Capital Gains Tax. If the item has increased in value during the period of ownership, the donor should expect to pay 24% Capital Gains Tax on the gain in value. The tax is the responsibility of the donor. Inheritance Tax (40%) can be relevant on a gift if the donor dies within seven years of making the gift, with certain exemptions. The rate of Inheritance Tax can reduce if death is more than three years after the gift. The tax is the responsibility of the donor’s executors but can become the responsibility of the recipient if the executors do not hold sufficient funds to meet the tax.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

As for France, family ties can determine tax liability. Transfer duties apply to gifts over €100,000 between a parent and child, and spouses of partners in a civil union. The progressive rate starts at 5% up to 45% for immediate partners and spouses. However, when the donation is made to a person without any family ties with the deceased, the rate amounts to 60% of the value of the gift.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

For Italian taxpayers, indirect Gift Tax is triggered from every lifetime gift or ‘donazione’. If the donor is resident in Italy, the tax follows the gift worldwide. If the donor lives abroad, only Italian‑sited assets are caught by taxation. Transfers to the children, spouse and parents, enjoy a generous €1000,000 tax-free allowance per person, with the excess taxed at 4%. Gifts among siblings are taxed at 6% after the first €100,000, and all other beneficiaries face tax at either 6–8% with no tax-free allowance at all.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Instead of a ‘set’ federal Gift Tax in Switzerland, each canton (region) sets their own rules regarding the imposition of gift taxes. This results in considerable variation throughout the country. For example, cantons like Schwyz and Obwalden entirely exempt all types of gifts from taxation, whilst Lucerne exempts donations from Gift Tax unless the donor dies within five years following the gift, triggering Inheritance Tax. In most cantons, transfers between spouses and direct descendants are exempt from Gift Tax.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.

All gifts made to English charities are completely exempt from both Capital Gains Tax and Inheritance Tax.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

In France, legatees or donors can gift art to charities with an exemption from transfer tax on gifts within certain limits. To benefit from this exemption, organizations must meet strict criteria, particularly with regard to their purpose, legal status, non-profit management, and non-commercial nature.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

A wide swathe of charitable bodies do not fall within the realm of gift tax in Italy, thus making a gift to a charity entirely tax-free. Foundations, associations, and similar establishments that are entirely devoted to research, assistance, education, or any other public utility purpose are completely outside the scope of the Gift Tax.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Donations to accredited non-profit organisations (NPOs) or similar institutions are exempt from gift tax in the majority of cantons (regions) in Switzerland. But at the federal level, private households may deduct donations in the form of monetary contributions as well as securities, real estate, or works of art, made to public-benefit organizations. Companies may deduct up to 20% of their net profit for qualifying donations.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.

Whilst there is no Capital Gains Tax exemption available if the donor is giving to another individual, Capital Gains Tax can be reduced under the Cultural Gifts Scheme in the UK. This is only if the item in question is pre-eminent (of national scientific historic or artistic interest) and the donor is prepared to transfer it to public ownership.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

Donations to charities may be eligible for tax relief for both individuals and businesses in France. For individuals, the tax reduction is 66% of the amount donated, the reduction applies to up to a limit of 20% taxable income. For businesses, the tax relief depends on the amount donated. For donations below € 2 million euros, the tax reduction is equal to 60% of the amount donated. When the total donated exceeds £2 million, the reduction is equal to 40% of the amount donated. A maximum reduction of €20,000 or 5% of turnover, whichever is higher, applies in both instances. Donations or bequests of real estate or monetary assets can also qualify for the same reductions, if they are designated for the acquisition, maintenance or preservation of cultural property.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

In Italy, gifts to a range of foundations, associations, and entities including those in EEA/EU territories are exempt from taxation – there are also exemptions for qualifying trusts, special funds or other dedicated vehicles set up solely for the care of disabled beneficiaries. One specific Italian tax exemption is designed for the generational handover of businesses, so long as the recipient keeps running the enterprise for at least five years. This can be relevant to the transfer of art assets; in case a parent wishes to transfer to his/her successor an art collection embedded in a company using the assets for exhibitions and trading.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Common exemptions in Switzerland include transfers to direct descendants and spouses. Gifts made to certified public-interest institutions are generally exempt. Small-value gifts to unrelated third parties may be exempt, subject to cantonal limits.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.