Insights

Ask Our Virtual Art Panel: Part 4

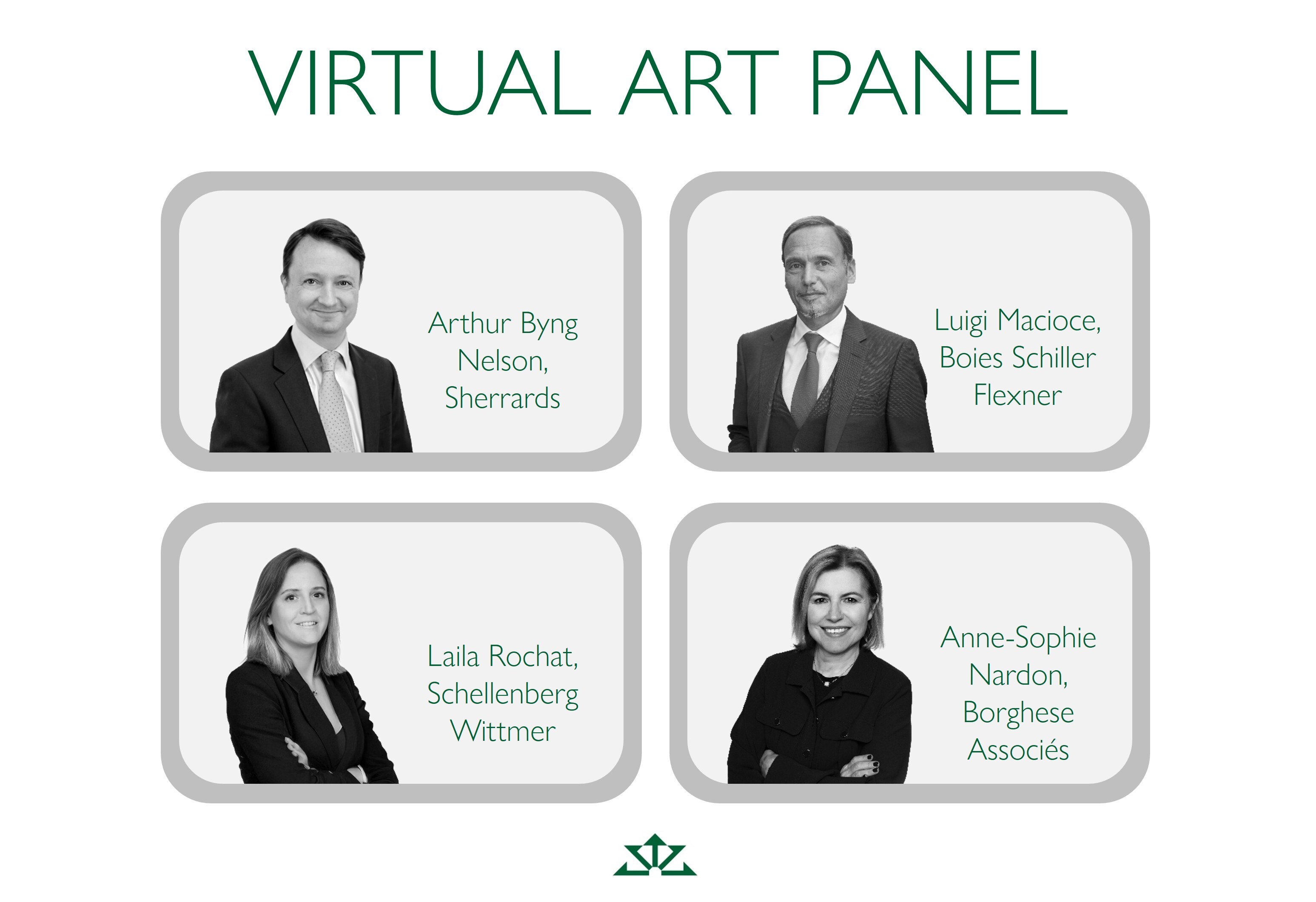

For Part 4 of this series, our 'virtual art panel' explain their jurisdictions' rules or taxes that apply to the export and import of cultural objects.

Part 1 | Part 2 | Part 3 | Part 5

Disclaimer

All legal responses contained herein were obtained as at 07.11.2025

Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate by changes in applicable laws and regulations. For example, the levels and bases of taxation may change.

This information should not be considered as tax advice. Tax treatment depends upon individual circumstances and individuals should seek professional tax advice as necessary.

Exporting cultural objects from the UK is not taxed, but export licenses are mandatory if the object meets certain age and value thresholds, which vary depending on type. For example, paintings and sculptures over 50 years old and worth more than £180,000 need a license. Manuscripts and archaeological items have even stricter controls. Objects containing certain endangered species materials, like ivory, require a CITES (Convention on International Trade in Endangered Species) permit.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

Exporting art objects inside EU is not taxed but depending on whether the export of the art object from France is permanent or temporary, the owner of the property must apply to the Ministry of Culture for either a temporary export authorization or an export certificate. Certain objects, such as cultural goods, may also require additional specific documentation. However, national treasures (cultural assets considered to be of major importance to the national heritage in terms of history, art, or archaeology) may not leave French customs territory, except for temporary exports within the EU, or for restoration purposes or participation in cultural events. Furthermore, European law requires obtaining an export license (temporary or permanent) for any export outside the territory of the European Union. Lastly, the sale or export of art objects outside the EU is subject to a flat-rate tax of 6.5% on capital gains, calculated on the sale price if the object is sold, or on the customs value if the object is exported.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

Italian law does not impose a tax on exporting artworks or antiquities, but it does subject them to a dense authorisation regime. Any object more than 70 years old and by a non-living artist, cannot leave Italy without an “attestato di libera circolazione” issued by the Ministry of Culture’s Export Offices. If an object is going to a non-EU country, the Export Offices must also issue a license for exportation. Works aged less than 70 years – or older works valued below €13,500, can travel on lighter self-certification. If an item is deemed a Cultural Asset (eg. a particularly important or exceptional cultural interest), clearance will be denied, and it could receive a permanent export ban, although the Ministry of Culture may authorise short loans for exhibitions. If clearance is granted, exportation entails no customs duty, VAT or other tax. Sales to non-EU buyers are VAT-exempt. Loans to foreign exhibitions follow a lighter procedure, although a temporary export license is still required and the object must be returned by a specific deadline.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

While the export, import, and transit of cultural property necessitate customs declarations, exports are generally exempt from customs duties and VAT, and restrictions are minimal. Export licenses are only mandatory for objects listed in the Swiss Inventory of Cultural Property of National and Regional Significance. This includes cultural assets like monuments, archaeological sites, and collections in museums and libraries. Certain cantons may impose additional restrictions on the export of items of local cultural importance. Collectors and dealers are advised to consult with cantonal cultural heritage authorities to ensure compliance with local regulations.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.

Import VAT is payable at the current rate of 5%. This is the same rate as was in effect before Brexit. CITES obligations also apply to imports, therefore the importer must obtain the necessary permits for legal entry.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

The main incentive is a reduced VAT rate of 5.5%. Imports must comply with EU Regulation 2019/880, which targets illicit trafficking and applies to cultural goods originating outside of the European Union. Goods that have been illicitly exported from their country of origin, notably in cases of looting or trafficking linked to war situations, are prohibited from entering the EU. Additionally, the regulations set out a restrictive list of cultural goods whose import is authorised but require an import license or declaration. The lists of cultural goods covered by the regulations can be accessed via this link. Finally, imports from certain non-EU Member States also require export authorization from the country of origin, according to French Heritage code.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

As of July 1, 2025, a reduced 5% VAT rate applies to imports of art, antiquities and collectibles to Italy, with no customs duties. VAT is suspended for objects coming in for temporary exhibit or restoration under the “temporary admissions” customs regime. Artworks more than 70 years old need an import clearance or license when they arrive from outside the EU and a shipment certificate when they are moved within the European Union. Importers must keep supporting paperwork for 20 years. From 28 June 2025, importers in Italy and every other Member State, are now required to obtain import licenses or submit importer statements through the ICG (Import Control System on cultural goods) platform. Import licenses are required for archaeological material and importer statements are required for all other cultural goods more than 200 years old and valued above €18,000.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

The import of cultural property into Switzerland is levied at 8.1% VAT and is subject to customs duties, although multiple exceptions or exemptions may apply. When customs duties do apply, they are calculated based on the gross weight and classification of the item; however, these duties generally constitute a minimal fraction of the artwork’s total value. Artists or museums importing original works of art may be exempt from VAT. Goods imported for temporary admission may defer VAT, subject to a financial guarantee. Bonded warehouses and art freeports in Geneva and Zurich, secure storage facilities where artworks can be held VAT-free under customs supervision, allow artworks to be imported without incurring taxes under specific circumstances, such as temporary storage, exhibitions, or sales.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.