Insights

Ask Our Virtual Panel: Part 2

Part 1 | Part 3 | Part 4 | Part 5

In Part 2 of this series, our 'virtual art panel' explain how their jurisdiction handles tax when it concerns gifts and bequests mortis causa (on death), discussing the specific rules that affect the way a collector can dispose of its estate upon death in their jurisdiction, and what taxes are triggered in death.

Disclaimer

All legal responses contained herein were obtained as at 07.11.2025

Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate by changes in applicable laws and regulations. For example, the levels and bases of taxation may change.

This information should not be considered as tax advice. Tax treatment depends upon individual circumstances and individuals should seek professional tax advice as necessary.

In England and Wales, ‘testamentary freedom’ applies, which means that a collector is totally free to decide to whom he or she leaves their assets in their will. In English law, moveable assets will be governed by the domicile of the deceased. One caveat to the principle of testamentary freedom is the Inheritance (Provision for Family and Dependants) Act 1975, which grants close family members or persons financially maintained by the deceased the opportunity to make a claim against the estate. To be successful, a claimant will have to persuade the court that the deceased failed to make reasonable financial provision for them.

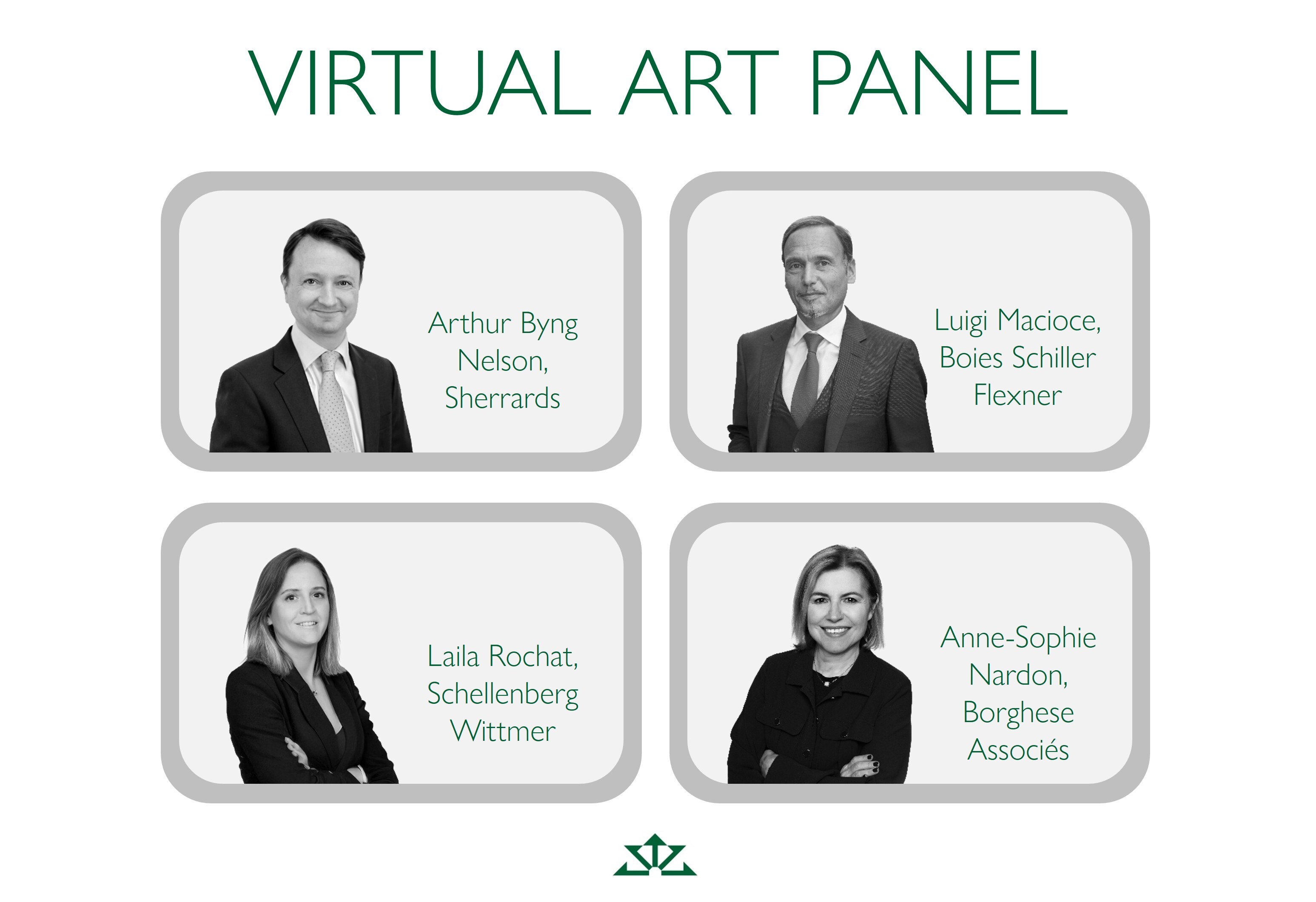

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

France, meanwhile, categorise children and grandchildren as ‘héritiers réservataires’ (reserved heirs). Reserved heirs always get a minimum share of the deceased’s estate. Gifts cannot exceed one half of the deceased’s property if he or she has one child, one third if he or she has two children or one quarter if he or she has three or more. A child may voluntarily waive their share of the reserve through a notarized agreement known as an advance waiver of the right to reduce the inheritance (RAAR). Overall, you cannot ‘disinherit’ your children in France.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

In Italy children (and their descendants, if the children cannot or do not inherit), spouses and parents are protected by a set of ‘forced heirship’ rules in Italy. Spouses and children – and in the absence of children (and their descendants) parents – (the “legittimari”) cannot be excluded from inheritance and are entitled to a specific portion of the deceased’s estate which depends on their relationship with the deceased and on the number of other forced heirs. Anything beyond that portion is the decedent’s free quota. If a will or a lifetime gift infringes the reserved shares, the forced heirs may bring an ‘azione di riduzione’ to claw back the excess.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Swiss inheritance law allows individuals to override the statutory rules of succession through wills or an inheritance agreement, but it protects certain heirs through the institution of reserved portions. Inheritance rights vary depending on the number of heirs entitled to a reserved share. For example, if the deceased leaves a spouse and two children, the spouse would normally be entitled to half of the estate. Their reserved portion is therefore one quarter of the estate. The two children would each be entitled to one quarter of the estate, so their respective reserved portions are one eighth of the estate. Beyond this legally protected share, the rest of the estate, including assets of cultural significance such as art collections, are freely disposable.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.

On the death of a collector artworks owned personally will be subject to Inheritance Tax at 40% of their deemed open market value. One “advantage” of death is that any pieces that have accumulated gain (risen in value) in the lifetime of the collector will not be subject to Capital Gains Tax: the death of the owner wipes out the gains.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

French Tax Code treats mortis causa transfers the same as lifetime gifts - these transfer duties are values as of the date of death, therefore, their value must be estimated on that date in order to be included in the tax assessment. The value of the estate is determined by public auction sale prices, if the sale occurs within two years of death; official inventories drawn up by an auctioneer, within five years of death; or by the detailed declaration and estimate of the parties.

The most secure way to estimate the value of an estate is by doing an inventory with the help of an auctioneer who will provide a report listing all the artworks and their estimated value. If the value of the objects from the sale/ inventory is different than the value declared in the insurance contract, an amending declaration must be made. Overpayments aren’t refunded, but underpayments may trigger additional tax.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

In Italy, the same tax bands that govern lifetime gifts also apply at death. If the deceased was an Italian‑resident, the tax bites on assets everywhere; if not, only on property located in Italy. Any artworks or antiques identified and registered by the Ministry of Culture (Heritage) as Cultural Assets are completely exempt from both estate and Inheritance Tax. Heirs who find Cultural Assets in the estate must, within thirty days of filing the declaration, notify the local Superintendency – failure to do so is a criminal offence and triggers expensive fines.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

In Switzerland, Inheritance Tax is levied exclusively at the cantonal (regional) level and typically follows principles similar to those governing Gift Tax. The deceased’s domicile at the time of death primarily determines the relevant Inheritance Tax regime, except for real estate, which is taxed by its location. Tax rates vary according to the relationship between the decedent and the beneficiary and the fair market value of the inherited assets. However, spouses and direct descendants generally qualify for exemption of the Inheritance Tax.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.