Insights

Ask Our Virtual Panel: Part 5

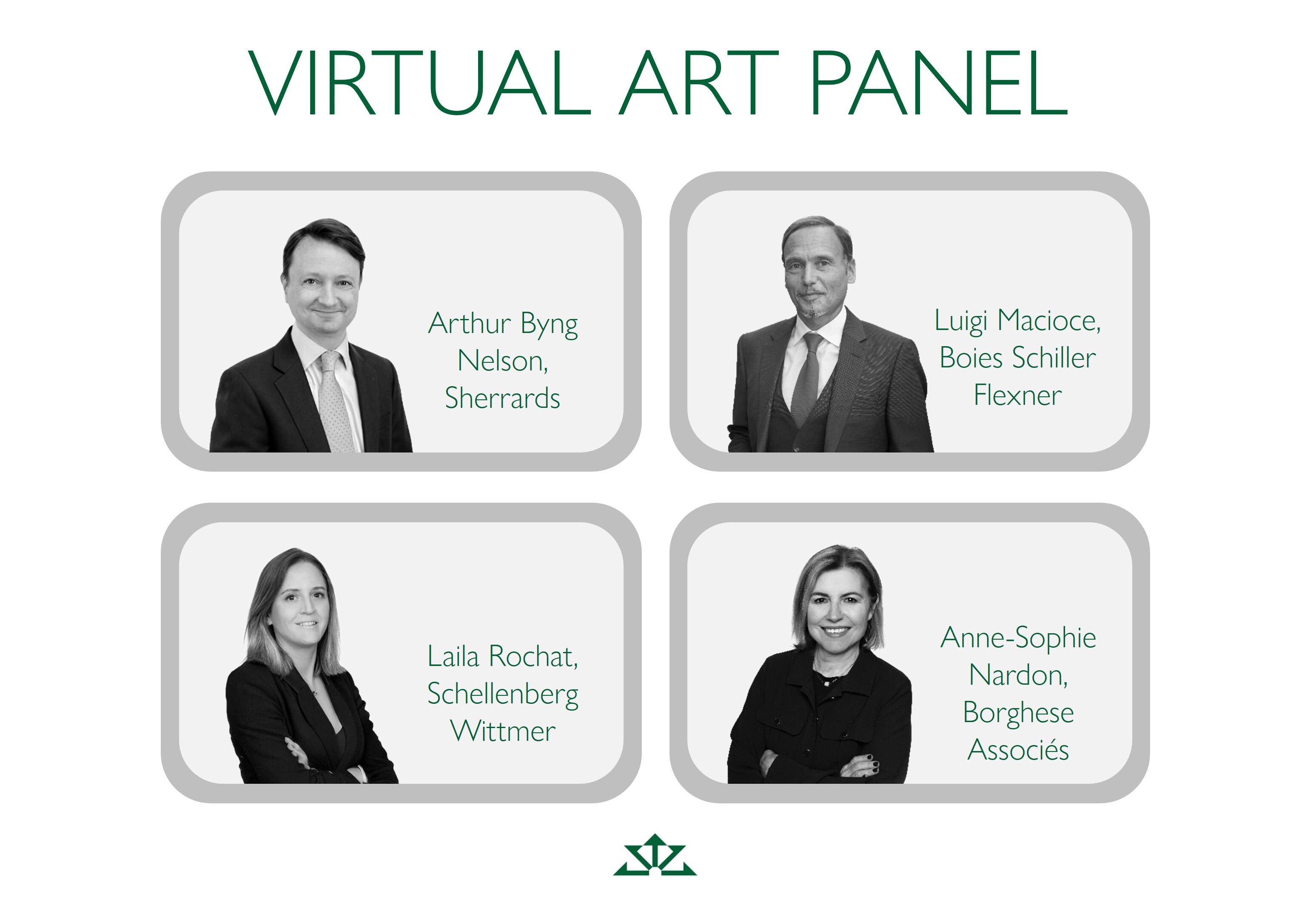

In Part 5 of this series, our 'virtual art panel' explains the rules for purchasing art in their jurisdiction, highlighting the top legal and tax considerations collectors should be aware of when purchasing art and other cultural objects.

Part 4 | Part 3 | Part 2 | Part 1

Disclaimer

All legal responses contained herein were obtained as at 07.11.2025

Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate by changes in applicable laws and regulations. For example, the levels and bases of taxation may change.

This information should not be considered as tax advice. Tax treatment depends upon individual circumstances and individuals should seek professional tax advice as necessary.

Purchases of art are subject to VAT (currently 20%). For second-hand artworks the Margin Scheme might apply, meaning VAT is only charged on the profit the seller makes, rather than on the full selling price. The intended result is more frequent and affordable transactions and therefore a more dynamic and fluid art market. The Artist’s Resale Right can be relevant on purchases of contemporary or modern art (up to 70 years after the artist’s death). The royalty is calculated on a sliding scale from 4% to 0.25%, depending on the sale price, capped at €12,500 per sale (the same as before Brexit). If an individual is simply selling a personally owned piece and he or she is not registered for VAT, and the sale is not part of a business activity, it falls outside the scope of VAT.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

Art sales in France follow the same general rules applicable to sale contracts, with some specific provisions around auctions, authenticity guarantees, resale rights and Capital Gains Tax. The VAT on artworks is 5.5%. A sale is valid when price and object are agreed, meaning a written contract of sale is not required, but it is always advisable. Auctioneer is a regulated profession in France and must adhere to specific rules and code of ethics as they are liable for 5 years after a sale. A legal mandate, the “Marcus decree”, defines the terms that can be used in the description of artworks. For instance, when the term 'by' or 'of' is followed by the artist's name, it is a guarantee that the artist in question is indeed the author. On the other hand, 'in the style of', 'in the manner of', 'type of' or 'after' are terms that offer no guarantee to the buyer. Sales through a professional dealer are subject to a resale right that benefits the artist and heirs 70 years after the artist’s death. Fees are calculated on a sliding scale from 4% to .25%. Sellers, who are French residents, should also be aware of Capital Gains Tax, which offers either a 6.5% flat rate or a declining rate over 22 years.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

As of July 1, 2025, purchases of art are subject to VAT at a 5% rate except where purchased under the margin scheme. Sales between private individuals are exempt. Sales involving a professional (for example gallery, dealer or auction house), also incur a droit de suite—a royalty which goes to the artist, or his/her heirs for 70 years after his/her death. This only applies to artworks above €3,000 and is calculated on a sliding scale from 4 % to .25% with a maximum of €12,500. If an object has been listed as a Cultural Asset, the sale must be reported to the Ministry of Culture within 30 days. The State then has 60 days to exercise the right of pre-emption to purchase instead. Failure to file the notice is a criminal offence and can lead to the seizure of the artwork.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Swiss law does not specifically regulate the acquisition of works of art. Therefore, it is the responsibility of the buyer to ensure lawful provenance and clear title, to avoid civil or criminal sanctions. From a Swiss tax perspective, a buyer or a seller whose activities could be considered professional, may trigger Income Tax and social security contributions on capital gains. Indicators of professional dealing might include frequent trading, short holding periods and reinvestment. Meeting just one of these criteria may suffice to classify the activity as professional. Private collectors are typically exempt from Capital Gains Tax. Additionally, sellers must charge VAT on art sales conducted within Switzerland if their taxable turnover exceeds CHF 100,000 annually. Exemptions exist for cultural services and original works.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.

First, provenance and title - it is essential to understand and follow the chain of ownership of an object to ensure the seller has good title and can therefore give good title to a new purchaser and ensure there are no grounds for any claims for repatriation or breach of export conditions. Secondly, pre-eminence - if an item is pre-eminent (of national, scientific, historic or artistic interest) then certain tax advantages might apply (but note possible future export restrictions). Thirdly, authenticity - check that the item sold is as described and check it again when it arrives for authenticity. Lastly, legal personality - consider whether purchasing a cultural object through a limited company or trust might be beneficial.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

Buyers should do their research - ask for a certificate of authenticity, proof that the artwork is included in the artist’s catalogue raisonné, or a condition report. If the work originates from a different country, ensure that the seller can provide the proper customs documentation. Red flags should never be ignored. If either the seller or object is dubious, buyers risk civil or criminal litigation if it turns out to be inauthentic, fake, or have an illicit provenance. This applies even to objects bought in good faith. For example, in the case of Nazi-looted art, French law compels the possessor to hand it back to the looted family without compensation, even if purchased legally. Suspiciously low prices or unclear provenance often indicate looted, or fake art. Careful due diligence can mitigate some risks. Databases such as the Art Loss Register, Interpol, or the French Directory for Looted Art allow potential buyers to search if the object has been declared stolen, lost or looted. Safeguard all acquisition-related documents. In case of a dispute, or when the collector wishes to resell, these can be vital.

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

Buyers should consider three main points. First, could the work be, or become, a Cultural Asset? The State enjoys a 60‑day right of first refusal and every future movement, loan or export must be cleared in advance. Second, attempting to export any work that is over 70 years old and valued above €13,500 is sometimes enough to trigger a listing as Cultural Asset. Third, be aware of the applicable VAT treatment. If the sale is made by a gallery or action house, VAT rate is 5% and the artist’s resale royalty (droit de suite) may be added on top of that. Buyers should also look at provenance, EU import rules and species protection certificates limits before signing. Obtaining a certificate of authenticity and lawful provenance from the seller—and, for older works, a copy of any prior export certificates— remains best practice.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

Due diligence regarding provenance and ownership is paramount to avoid legal liability and to preserve the artwork’s market value. Collectors must consider the intended use and holding period of the artwork, as commercial activities may result in taxable income on gains. Other tax implications vary significantly across cantons, particularly regarding gifts, inheritance, and wealth taxes. Storage location and mode of display may also influence tax. For example, in Geneva, artwork displayed in a private residence is generally exempt from wealth tax, whereas identical pieces stored in a safety deposit box are included. Therefore, collectors should evaluate not only the purchase but also subsequent management and use of the artwork within the context of the relevant cantonal tax laws.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.