Insights

Ask Our Virtual Panel: Part 3

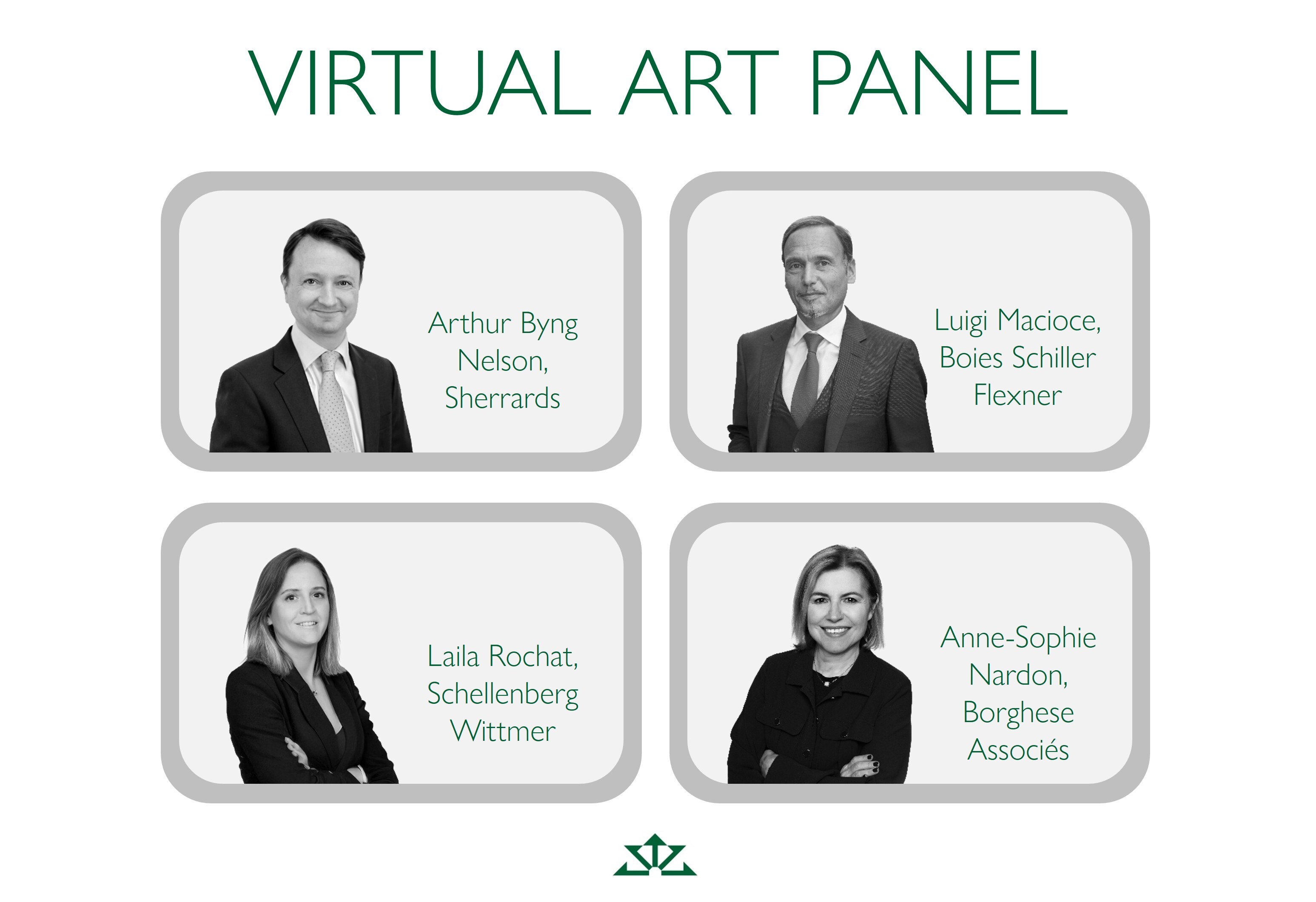

In Part 3 of this series, our 'virtual art panel' explain what the incentives are for collectors to transfer cultural property to the State in their respective jurisdictions.

Part 1 | Part 2 | Part 4 | Part 5

Disclaimer

All legal responses contained herein were obtained as at 07.11.2025

Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate by changes in applicable laws and regulations. For example, the levels and bases of taxation may change.

This information should not be considered as tax advice. Tax treatment depends upon individual circumstances and individuals should seek professional tax advice as necessary.

The Cultural Gifts Scheme exists to encourage lifetime gifts of valuable works of art and heritage objects to public collections in exchange for a reduction in Capital Gains Tax or Income Tax or Corporation Tax. The Acceptance In Lieu Scheme offers the possibility to meet an Inheritance Tax liability by transferring ownership of a pre-eminent item to the nation. The Conditional Exemption Scheme allows the owner of a pre-eminent item to postpone an obligation to pay Inheritance Tax if he or she agrees to provide access to that item to the public for at least 28 days a year.

Arthur Byng Nelson, Partner and Head of Art & Heritage at Sherrards in London.

“Malraux law” allows collectors, their heirs or beneficiaries to be exempt from Gift Tax by giving artworks, books, or any document of high artistic or historical value to the State.[1] However, donors can retain possession of the object until after their death, and that of their spouse, before the transfer occurs.[2] This requires prior acceptance by the State, who will also determine the value of the proposed gift. Donations and bequests of works of art, books, and other objects of historical interest, when made available to the public in museums, libraries or heritage institutions, are also exempt from transfer duties.

[1] Law n°68-1251 of December 31st, 1968, art. 1

[2] Law n°68-1251 of December 31st, 1968, art. 1

Anne-Sophie Nardon, Art and Cultural Property specialist at Paris law firm, Borghese Associés.

Gift and Inheritance Tax are removed from any transfer made to the Italian State. This includes Regions, Provinces, or Municipalities. The value of the artwork therefore never enters the tax computation. The “acceptance-in-lieu” rule lets collectors use art to satisfy, in whole or part, estate/inheritance taxes by ceding cultural assets or artworks to the State, provided the Ministry of Culture agrees to the acquisition. A similar rule extends the option to outstanding income-tax liabilities. If a piece is merely lent for public exhibition, the owner can still benefit from a partial deduction on ordinary income-tax for the costs of maintenance and insurance. This “Art Bonus” provides a 65% credit for funding eligible restoration.

Luigi Macioce, Partner at Boies Schiller Flexner, who have offices in Milan and Rome.

A few cantons (regions), including Geneva, Vaud and Jura allow taxpayers to discharge Gift or Inheritance Tax obligations through the transfer of cultural assets to the State, referred to as “gift in lieu of payment” (dation en paiement). This is subject to certain conditions, and the asset must meet a threshold of cultural relevance and value as determined by the canton. While the process is voluntary, a formal agreement through the completion of a public law contract between the taxpayer and the State is required. Use of dation en paiement in Switzerland remains relatively rare, as tax regimes differ across cantons. As a result, only a limited number of cases have been recorded to date.

Based in Geneva, Laila Rochat is a Partner in the Taxation Group at Schellenberg Wittmer.